Question: A1 A2 A3 A4 A5 A6 A7 8.7 6.7 10.7 102.7 96.65 100.67 105.24 Problem A Construct a Replicating Portfolio (RP) to replicate a 1.5-year

| A1 | A2 | A3 | A4 | A5 | A6 | A7 |

| 8.7 | 6.7 | 10.7 | 102.7 | 96.65 | 100.67 | 105.24 |

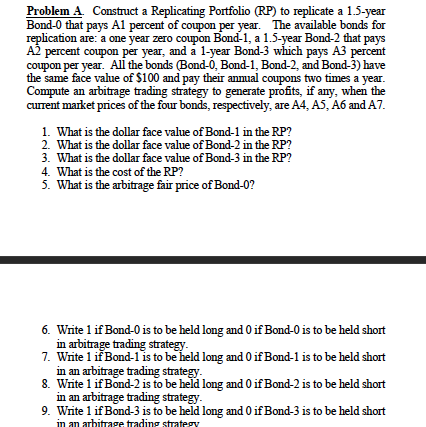

Problem A Construct a Replicating Portfolio (RP) to replicate a 1.5-year Bond-0 that pays Al percent of coupon per year. The available bonds for replication are: a one year zero coupon Bond-1, a 1.5-year Bond-2 that pays A2 percent coupon per year, and a 1-year Bond-3 which pays A3 percent coupon per year. All the bonds (Bond-0, Bond-1, Bond-2, and Bond-3) have the same face value of S100 and pay their anmual coupons two times a year. Compute an arbitrage trading strategy to generate profits, if any, when the current market prices of the four bonds, respectively, are A4, A5, A6 andA7. 1. What is the dollar face value of Bond-1 in the RP? 2. What is the dollar face value of Bond-2 in the RP? 3. What is the dollar face value of Bond-3 in the RP? 4. What is the cost of the RP? 5. What is the arbitrage fair price of Bond-0? 6. Write 1 if Bond-0 is to be held long and 0 if Bond-0 is to be held short 6. Write 1 if Bond-0 is to be held long and 0if Bond-0is 7. Wnte 1 if Bond-1 is to be held long and 0 if Bond-1 is to be held short 8. Wrte 1ifBond-2 is to be held long and 0 ifBond-2 is to be held short 9. Write 1 if Bond-3 is to be held long and 0 if Bond-3 is to be held short in arbitrage trading strategy in an arbitrage trading strategy in an arbitrage trading strategy in an arhittage trading strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts