Question: A1 B D E F H 1 J K L M N 0 P R s T v w 1 2 Intermediate Time-Value of Money

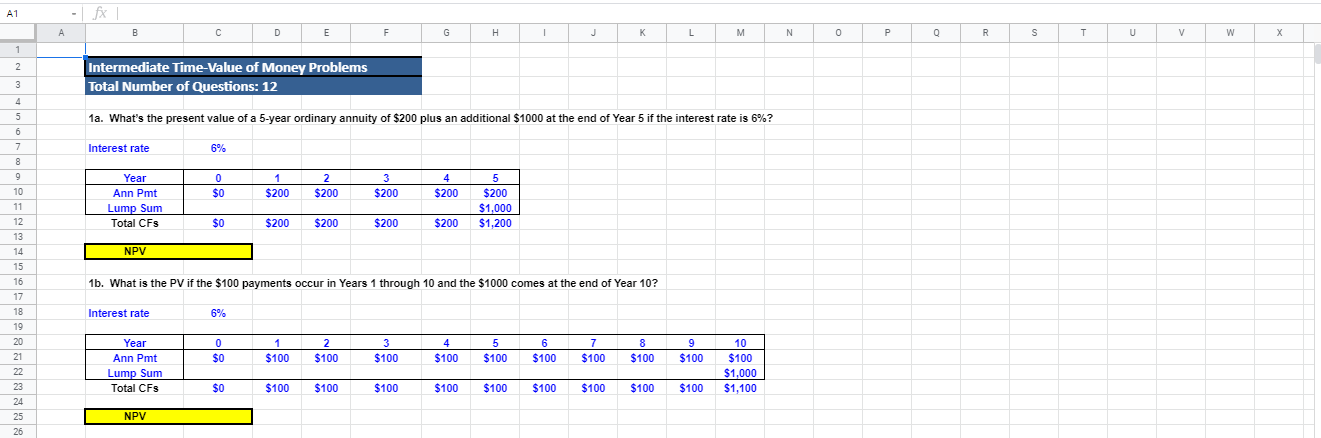

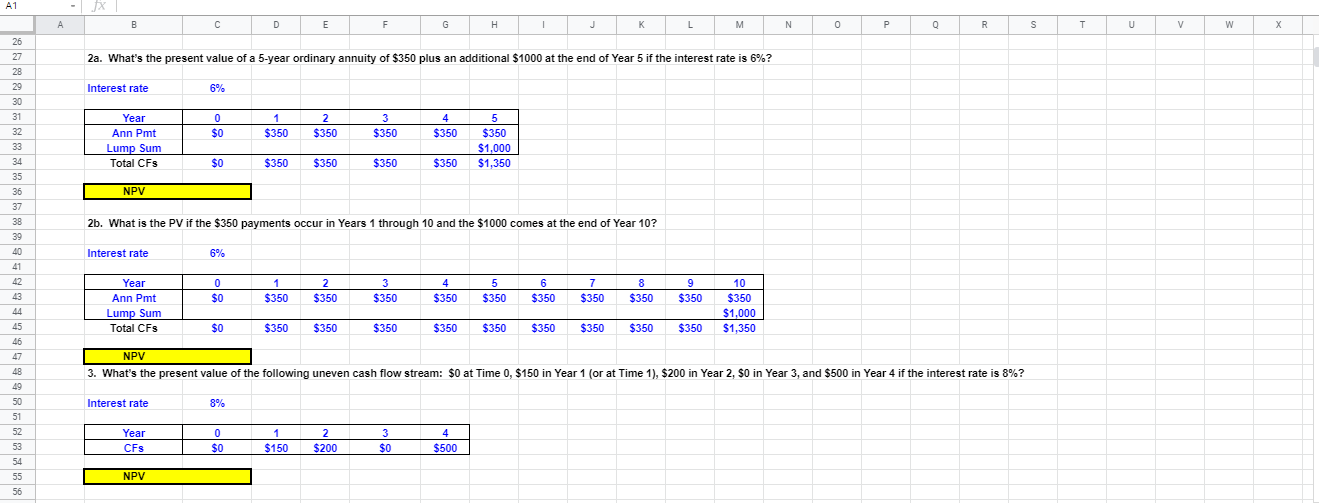

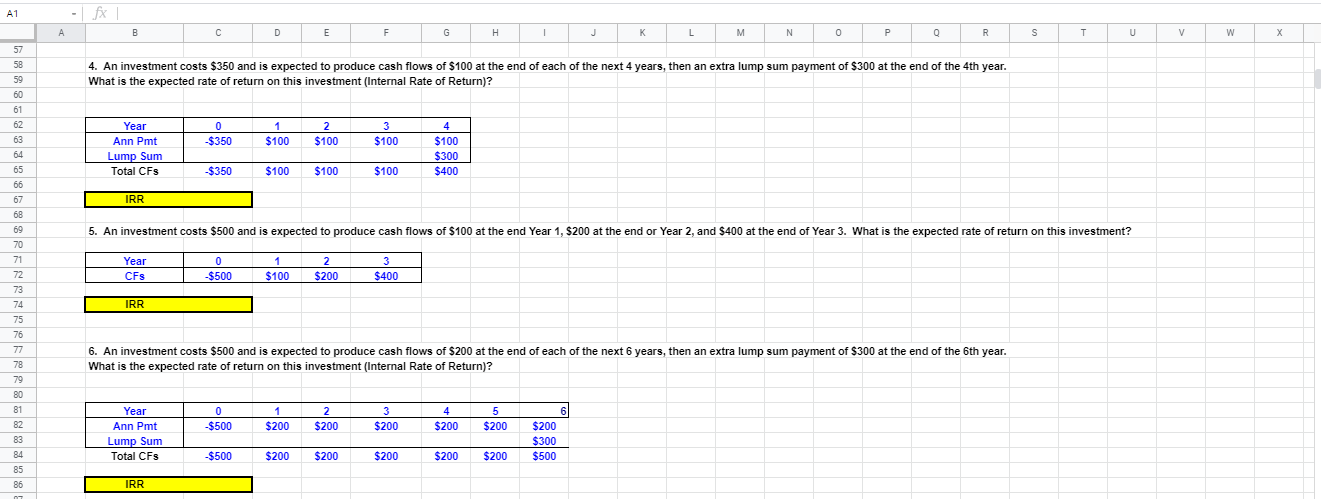

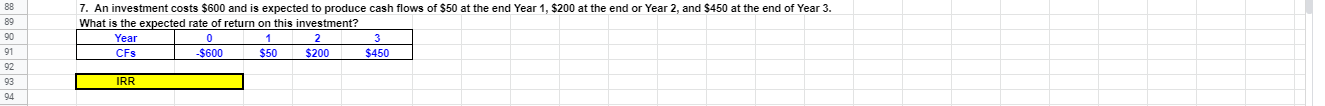

A1 B D E F H 1 J K L M N 0 P R s T v w 1 2 Intermediate Time-Value of Money Problems Total Number of Questions: 12 3 4 1a. What's the present value of a 5-year ordinary annuity of $200 plus an additional $1000 at the end of Year 5 if the interest rate is 6%? Interest rate 6% 5 6 7 8 9 10 11 12 13 0 $0 $ 1 $200 2 $200 3 $200 4 $200 Year Ann Pmt Lump Sum Total CFS 5 $200 $1,000 $1,200 $0 $200 $200 $200 $200 14 NPV 1b. What is the PV if the $100 payments occur in Years 1 through 10 and the $1000 comes at the end of Year 10? 15 16 17 18 19 20 21 Interest rate 6% Year 0 1 $100 2 $100 3 $100 4 $100 5 $100 6 $100 7 $100 8 $100 9 $100 $0 10 $100 $1,000 $1,100 Ann Pmt Lump Sum Total CFs 22 23 24 $0 $100 $100 $100 $100 $100 $100 $100 $100 $100 NPV 25 26 A1 fx A B D E F G H 1 J K L M N N 0 R S T V w W 2a. What's the present value of a 5-year ordinary annuity of $350 plus an additional $1000 at the end of Year 5 if the interest rate is 6%? Interest rate 6% 3 26 27 28 29 30 31 32 33 34 35 36 37 0 $0 1 $350 2 $350 4 $350 $350 Year Ann Pmt Lump Sum Total CFS 5 $350 $1,000 $1,350 $0 $350 $350 $350 $350 NPV 2b. What is the PV if the $350 payments occur in Years 1 through 10 and the $1000 comes at the end of Year 10? 38 39 40 41 Interest rate 6% 4 0 $0 1 $350 2 $350 3 $350 5 $350 6 $350 7 $350 9 $350 $350 $350 Year Ann Pmt Lump Sum Total CFs 10 $350 $1,000 $1,350 $0 $350 $350 $350 $350 $350 $350 $350 $350 $350 NPV 3. What's the present value of the following uneven cash flow stream: $0 at Time 0, $150 in Year 1 (or at Time 1), $200 in Year 2, SO in Year 3, and $500 in Year 4 if the interest rate is 8%? 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 Interest rate 8% Year CFs 0 $0 1 $150 2 $200 3 $0 4 $500 NPV A1 - fx B D E F G H 1 K L M N N 0 P R S T U v w 57 58 59 60 4. An investment costs $350 and is expected to produce cash flows of $100 at the end of each of the next 4 years, then an extra lump sum payment of $300 at the end of the 4th year. What is the expected rate of return on this investment (Internal Rate of Return)? 61 3 62 63 0 -$350 1 $100 2 $100 $100 Year Ann Pmt Lump Sum Total CFS 4 $100 $300 $400 64 $350 $100 $100 $100 IRR 5. An investment costs $500 and is expected to produce cash flows of $100 at the end Year 1, $200 at the end or Year 2, and $400 at the end of Year 3. What is the expected rate of return on this investment? Year CFS 0 -$500 1 $100 2 $200 3 $400 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 IRR 6. An investment costs $500 and is expected to produce cash flows of $200 at the end of each of the next 6 years, then an extra lump sum payment of $300 at the end of the 6th year. What is the expected rate of return on this investment (Internal Rate of Return)? 0 $500 1 $200 2 $200 3 $200 4 $200 5 $200 82 83 84 Year Ann Pmt Lump Sum Total CFS $200 $300 $500 $500 $200 $200 $200 $200 $200 85 86 IRR 89 90 91 7. An investment costs $600 and is expected to produce cash flows of $50 at the end Year 1, $200 at the end or Year 2, and $450 at the end of Year 3. What is the expected rate of return on this investment? Year 0 2 3 CFs $600 $50 $200 $450 93 94 IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts