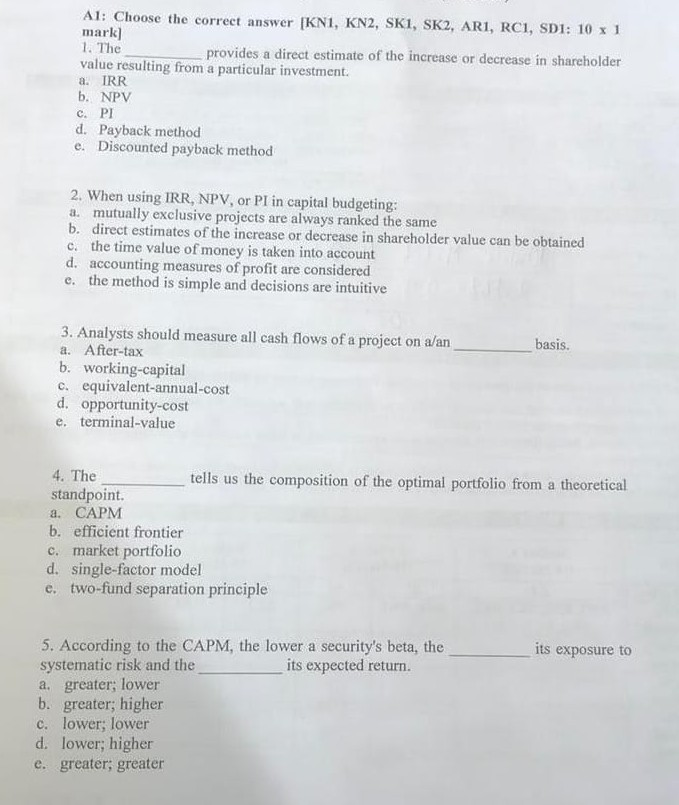

Question: A1: Choose the correct answer [KN1, KN2, SKI, SK2, AR1, RC1, SD1: 10 x 1 mark] 1. The provides a direct estimate of the increase

A1: Choose the correct answer [KN1, KN2, SKI, SK2, AR1, RC1, SD1: 10 x 1 mark] 1. The provides a direct estimate of the increase or decrease in shareholder value resulting from a particular investment. a. IRR b. NPV C. PI d. Payback method e. Discounted payback method 2. When using IRR, NPV, or PI in capital budgeting: a. mutually exclusive projects are always ranked the same b. direct estimates of the increase or decrease in shareholder value can be obtained c. the time value of money is taken into account d. accounting measures of profit are considered e. the method is simple and decisions are intuitive basis. 3. Analysts should measure all cash flows of a project on a/an a. After-tax b. working-capital c. equivalent-annual-cost d. opportunity-cost e. terminal-value 4. The tells us the composition of the optimal portfolio from a theoretical standpoint. a. CAPM b. efficient frontier c. market portfolio d. single-factor model e. two-fund separation principle its exposure to 5. According to the CAPM, the lower a security's beta, the systematic risk and the its expected return. a. greater; lower b. greater; higher c. lower; lower d. lower; higher e. greater; greater

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts