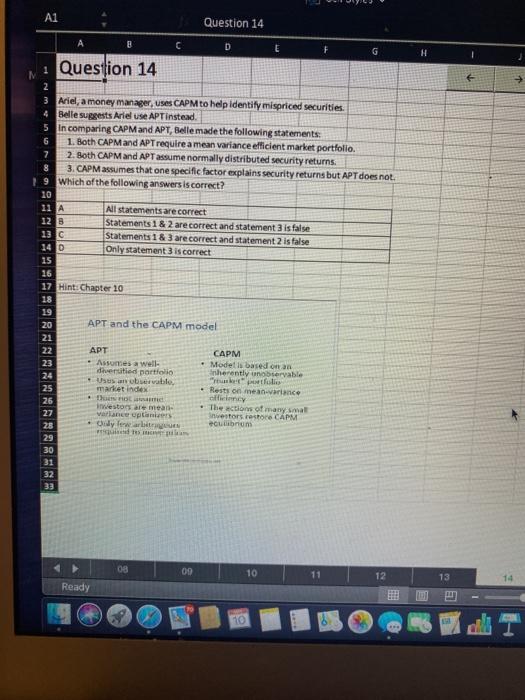

Question: A1 Question 14 B C D E 1 Question 14 2 3 Ariel, a money manager, uses CAPM to help identify mispriced securities. 4 Belle

A1 Question 14 B C D E 1 Question 14 2 3 Ariel, a money manager, uses CAPM to help identify mispriced securities. 4 Belle suggests Arieluse APTinstead 5 In comparing CAPM and APT, Belle made the following statements: 6 1. Both CAPM and APT require a mean variance efficient market portfolio 7 2. Both CAPM and APTassume normally distributed security returns 8 3. CAPM assumes that one specific factor explains security returns but APT does not 19 Which of the following answers is correct? 10 11 A All statements are correct 12 B Statements 1 & 2 are correct and statement 3 is false 13C Statements 1&3 are correct and statement is false 14 0 Only statement 3 is correct 15 16 17 Hint: Chapter 10 18 19 20 APT and the CAPM model 21 22 APT 23 Assumes a well- . Modet is based on an dheritied portfolio Inherently observable 24 USUS avevable, skrofuli 25 market index Rests on mean variance 26 .th Inwestors are mean The action of many smal 27 variance upons Investors.reston CAPM 28 dy few are cubruns Nam 29 30 31 32 33 CAPM 08 09 10 11 12 13 14 Ready BE 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts