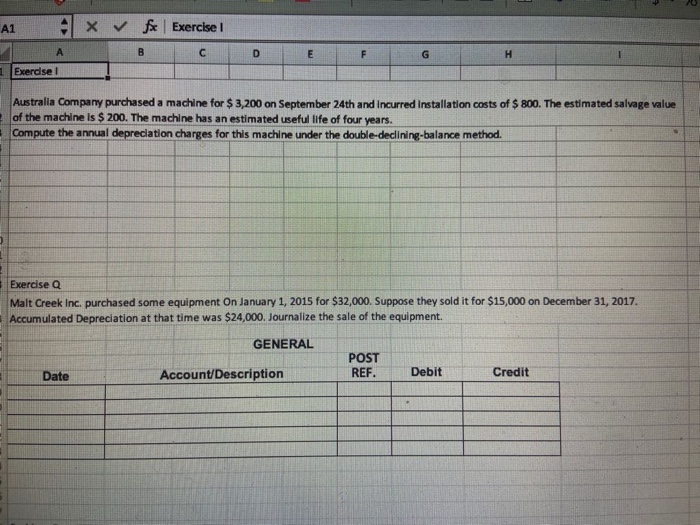

Question: A1 x fx B Exercise ! C D E F G Exerdsel Australia Company purchased a machine for $3,200 on September 24th and incurred installation

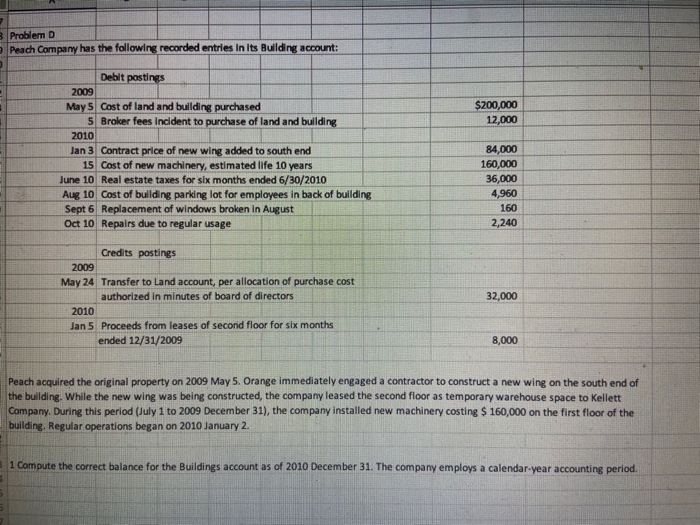

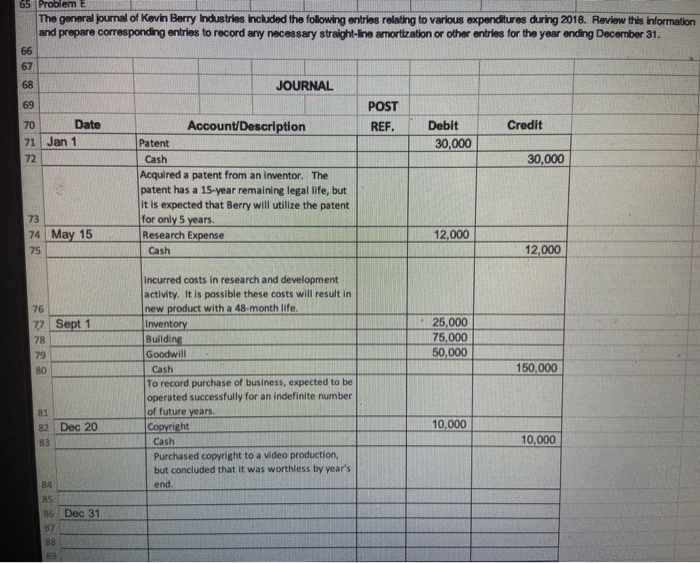

A1 x fx B Exercise ! C D E F G Exerdsel Australia Company purchased a machine for $3,200 on September 24th and incurred installation costs of $ 800. The estimated salvage value of the machine is $ 200. The machine has an estimated useful life of four years. Compute the annual depreciation charges for this machine under the double-declining balance method. Exercise Q Malt Creek Inc. purchased some equipment On January 1, 2015 for $32,000. Suppose they sold it for $15,000 on December 31, 2017. Accumulated Depreciation at that time was $24,000. Journalize the sale of the equipment. GENERAL POST REF. Date Account/Description Credit Debit Problem D Peach Company has the following recorded entries in its Ruilding account: $200,000 12,000 Debit postings 2009 May 5 Cost of land and building purchased 5 Broker fees incident to purchase of land and building 2010 Jan 3 Contract price of new wing added to south end 15 Cost of new machinery, estimated life 10 years June 10 Real estate taxes for six months ended 6/30/2010 Aug 10 Cost of building parking lot for employees in back of building Sept 6 Replacement of windows broken in August Oct 10 Repairs due to regular usage 84,000 160,000 36,000 4,960 160 2,240 Credits postings 2009 May 24 Transfer to Land account, per allocation of purchase cost authorized in minutes of board of directors 2010 Jan 5 Proceeds from leases of second floor for six months ended 12/31/2009 32,000 8,000 Peach acquired the original property on 2009 May 5. Orange immediately engaged a contractor to construct a new wing on the south end of the building. While the new wing was being constructed, the company leased the second floor as temporary warehouse space to kellett Company. During this period (July 1 to 2009 December 31), the company installed new machinery costing $ 160,000 on the first floor of the building. Regular operations began on 2010 January 2. 1 Compute the correct balance for the Buildings account as of 2010 December 31. The company employs a calendar year accounting period 65 Problem E The general Journal of Kevin Berry Industries included the following entries relating to various expenditures during 2018. Review this information and prepare corresponding entries to record any necessary straight-line amortization or other entries for the year ending December 31. JOURNAL POST REF. Credit Date Jan 1 Debit 30,000 30,000 Account/Description Patent Cash Acquired a patent from an inventor. The patent has a 15-year remaining legal life, but it is expected that Berry will utilize the patent for only 5 years. Research Expense Cash 74 May 15 12,000 12,000 Sept 25,000 75,000 50,000 150,000 Incurred costs in research and development activity. It is possible these costs will result in new product with a 48-month life. Inventory Building Goodwill Cash To record purchase of business, expected to be operated successfully for an indefinite number of future years. Copyright Cash Purchased copyright to a video production, but concluded that it was worthless by year's end 82 Dec 20 10,000 10,000 86 Dec 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts