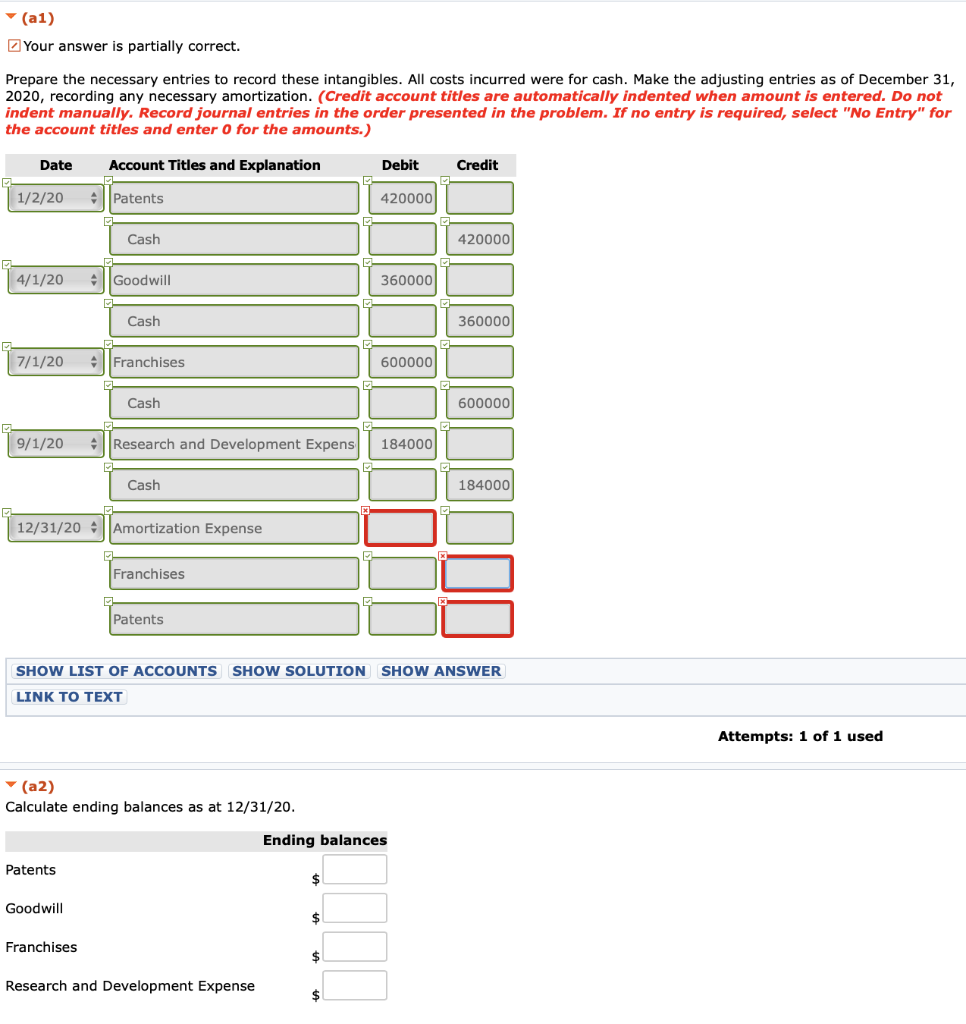

Question: - (a1) Z Your answer is partially correct. Prepare the necessary entries to record these intangibles. AlIl costs incurred were for cash. Make the

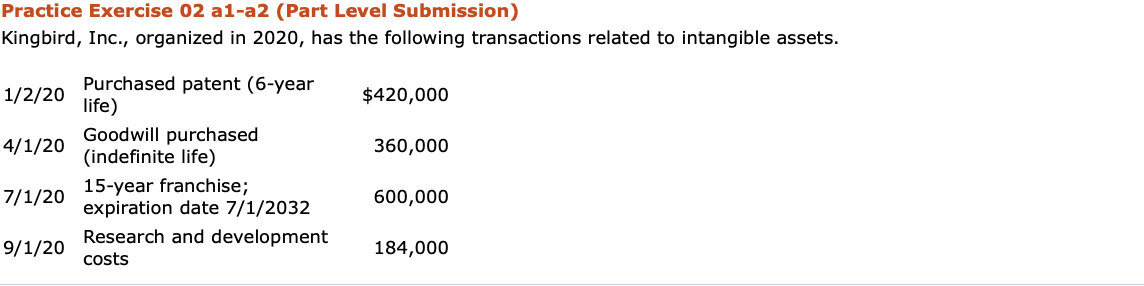

- (a1) Z Your answer is partially correct. Prepare the necessary entries to record these intangibles. AlIl costs incurred were for cash. Make the adjusting entries as of December 31, 2020, recording any necessary amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit 1/2/20 Patents 420000 Cash 420000 4/1/20 Goodwill 360000 Cash 360000 7/1/20 Franchises 600000 Cash 600000 9/1/20 +Research and Development Expens 184000 Cash 184000 12/31/20 Amortization Expense Franchises Patents SHOW LIST OF ACCOUNTS SHOW SOLUTION SHOW ANSWER LINK TO TEXT Attempts: 1 of 1 used * (a2) Calculate ending balances as at 12/31/20. Ending balances Patents 2$ Goodwill 2$ Franchises 2$ Research and Development Expense 2$ Practice Exercise 02 a1-a2 (Part Level Submission) Kingbird, Inc., organized in 2020, has the following transactions related to intangible assets. Purchased patent (6-year life) Goodwill purchased (indefinite life) 1/2/20 $420,000 4/1/20 360,000 15-year franchise; expiration date 7/1/2032 Research and development 7/1/20 600,000 9/1/20 184,000 costs

Step by Step Solution

3.63 Rating (160 Votes )

There are 3 Steps involved in it

Based on the provided information and the images it seems youre working on recording journal entries for intangible assets Lets analyze and answer the ... View full answer

Get step-by-step solutions from verified subject matter experts