Question: A11 pt 2 Exercise #2: Consider the following table. This is part of the process of projecting loan losses on a single loan or a

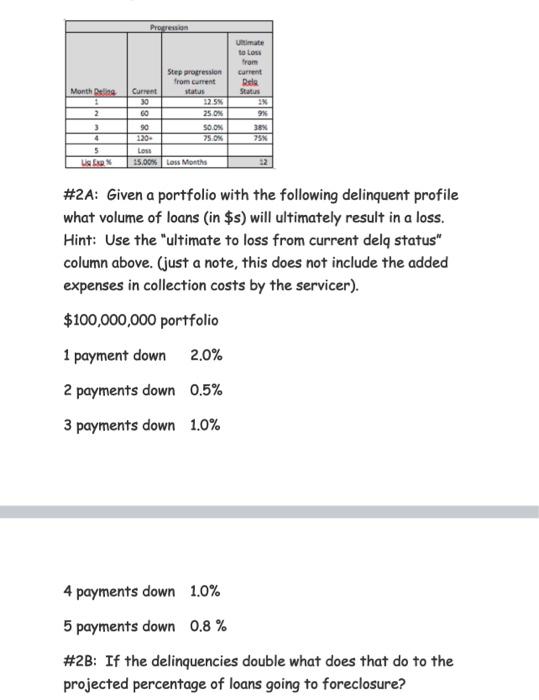

Exercise #2: Consider the following table. This is part of the process of projecting loan losses on a single loan or a portfolio of loans. A couple of the key projections (assumptions) include the progression from one delinquency status to the next, liquidation expenses (see the readings), and the time period until ultimate resolution if the loan progresses all the way through foreclosure to REO (Real estate owned, meaning property acquired by the lender through foreclosure that then has to be sold). The progression means what percentage of the loans that are currently one-month delinquent will advance to two months, etc. In the example below 12.5 percent of those loans currently one-month delinquent will advance to being two- months delinquent, 25% of those two months will advance to be three-months. Progression Month Deine 1 2 3 4 5 Us Step progression from current Current status 30 12.5% GO 25 90 S0.0% 220 75.0 Los 15,00% Loss Months to low from current Dale Status 3X 9 38% 75% 32 #2A: Given a portfolio with the following delinquent profile what volume of loans (in $s) will ultimately result in a loss. Hint: Use the "ultimate to loss from current dela status" column above. (just a note, this does not include the added expenses in collection costs by the servicer). $100,000,000 portfolio 1 payment down 2.0% 2 payments down 0.5% 3 payments down 1.0% 4 payments down 1.0% 5 payments down 0.8 % #2B: If the delinquencies double what does that do to the projected percentage of loans going to foreclosure? Exercise #2: Consider the following table. This is part of the process of projecting loan losses on a single loan or a portfolio of loans. A couple of the key projections (assumptions) include the progression from one delinquency status to the next, liquidation expenses (see the readings), and the time period until ultimate resolution if the loan progresses all the way through foreclosure to REO (Real estate owned, meaning property acquired by the lender through foreclosure that then has to be sold). The progression means what percentage of the loans that are currently one-month delinquent will advance to two months, etc. In the example below 12.5 percent of those loans currently one-month delinquent will advance to being two- months delinquent, 25% of those two months will advance to be three-months. Progression Month Deine 1 2 3 4 5 Us Step progression from current Current status 30 12.5% GO 25 90 S0.0% 220 75.0 Los 15,00% Loss Months to low from current Dale Status 3X 9 38% 75% 32 #2A: Given a portfolio with the following delinquent profile what volume of loans (in $s) will ultimately result in a loss. Hint: Use the "ultimate to loss from current dela status" column above. (just a note, this does not include the added expenses in collection costs by the servicer). $100,000,000 portfolio 1 payment down 2.0% 2 payments down 0.5% 3 payments down 1.0% 4 payments down 1.0% 5 payments down 0.8 % #2B: If the delinquencies double what does that do to the projected percentage of loans going to foreclosure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts