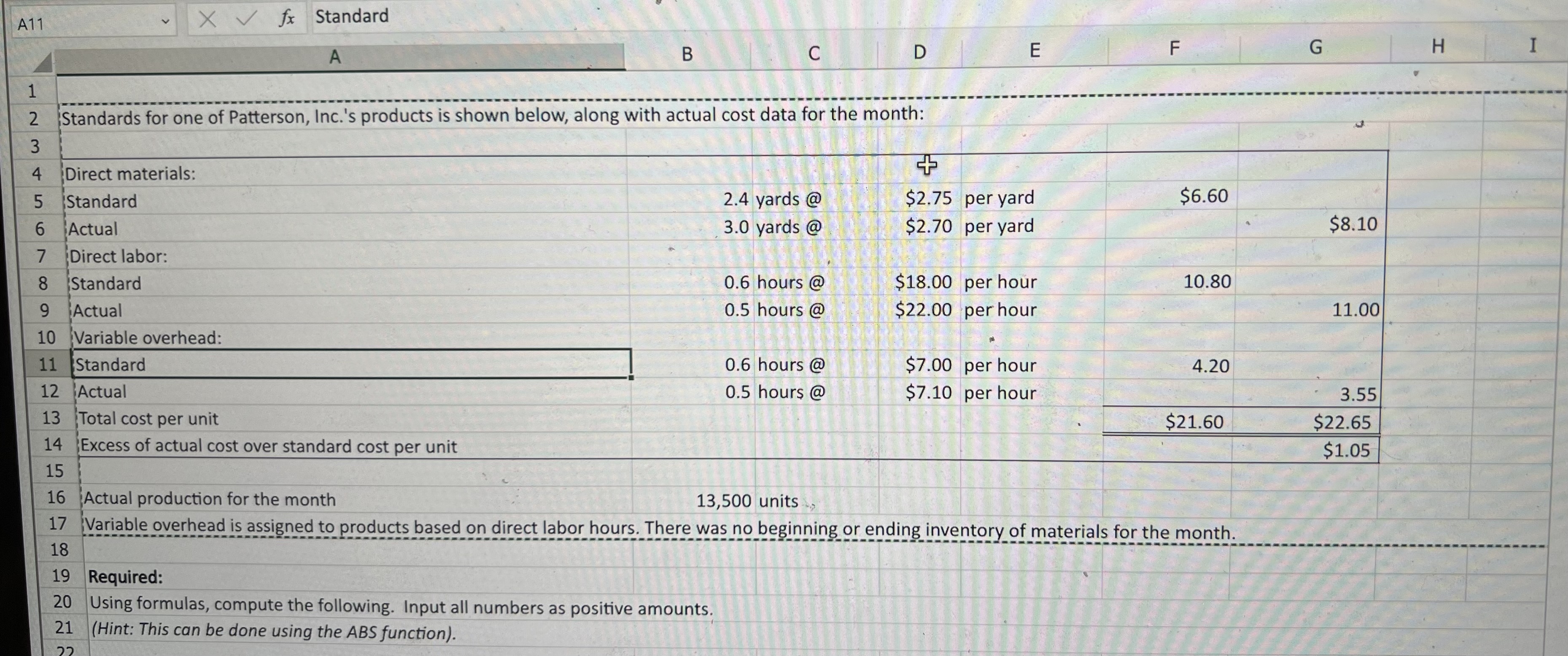

Question: A11 X V fx Standard A B C D E F G H I N Standards for one of Patterson, Inc.'s products is shown below,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock