Question: A12 Please help!! You are looking to make a purchase offer based on the following assumed income and expenses. Anticipated life: 5 years Expenses: year

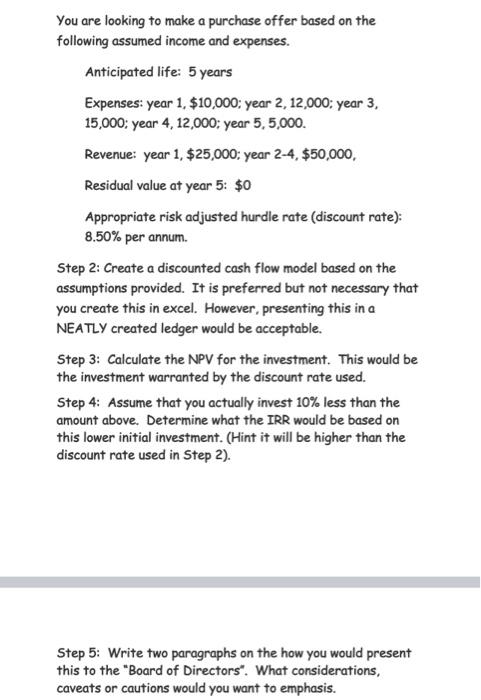

You are looking to make a purchase offer based on the following assumed income and expenses. Anticipated life: 5 years Expenses: year 1, $10,000; year 2, 12,000; year 3, 15,000; year 4, 12,000; year 5,5,000. Revenue: year 1, $25,000; year 2-4, $50,000, Residual value at year 5: $0 Appropriate risk adjusted hurdle rate (discount rate): 8.50% per annum. Step 2: Create a discounted cash flow model based on the assumptions provided. It is preferred but not necessary that you create this in excel. However, presenting this in a NEATLY created ledger would be acceptable. Step 3: Calculate the NPV for the investment. This would be the investment warranted by the discount rate used. Step 4: Assume that you actually invest 10% less than the amount above. Determine what the IRR would be based on this lower initial investment. (Hint it will be higher than the discount rate used in Step 2). Step 5: Write two paragraphs on the how you would present this to the Board of Directors". What considerations, caveats or cautions would you want to emphasis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts