Question: A19-4 Defined Contribution Plan (LO 19-2) Zlo Ltd. established a defined contribution pension plan at the beginning of 20X9. The company will contribute 2% of

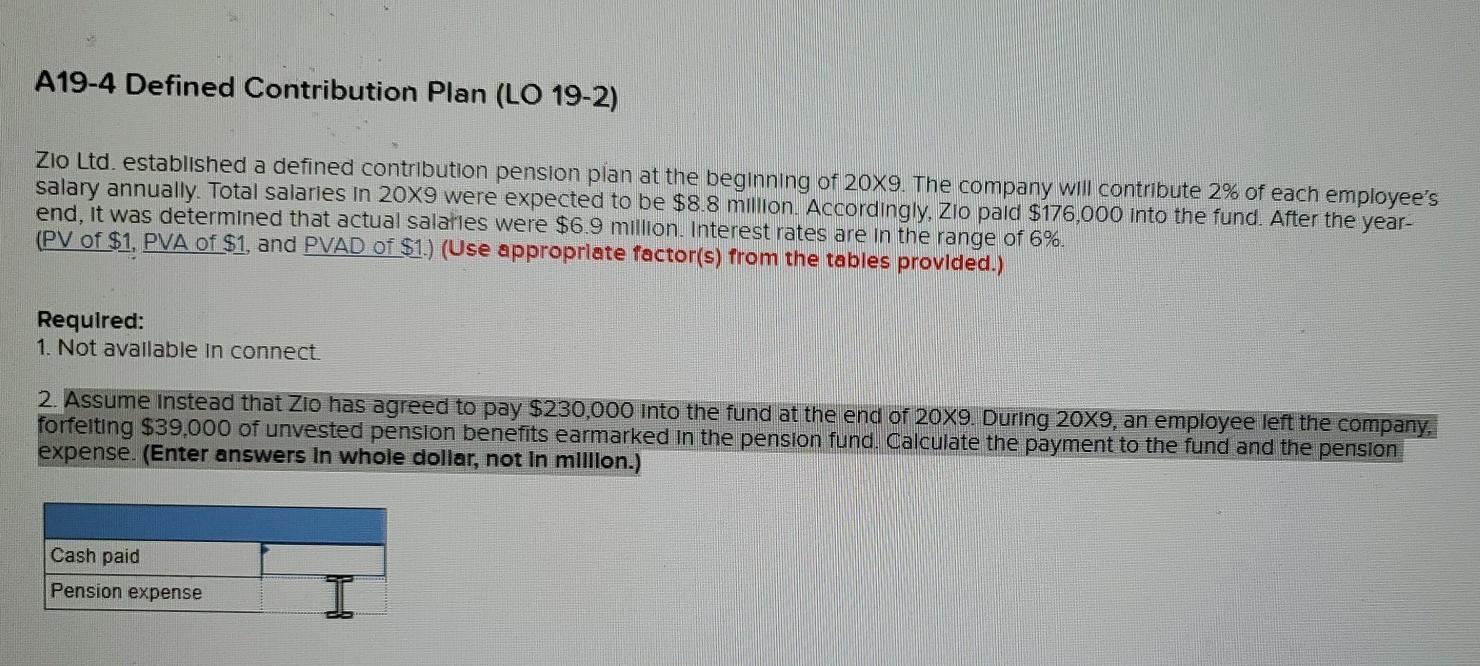

A19-4 Defined Contribution Plan (LO 19-2) Zlo Ltd. established a defined contribution pension plan at the beginning of 20X9. The company will contribute 2% of each employee's salary annually. Total salaries in 20x9 were expected to be $8.8 million. Accordingly, Zio pald $176,000 into the fund. After the year- end, it was determined that actual salaries were $6.9 million. Interest rates are in the range of 6%. (PV of $1. PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Not available in connect. 2. Assume Instead that Zio has agreed to pay $230,000 Into the fund at the end of 20X9. During 20X9, an employee left the company, forfeiting $39,000 of unvested pension benefits earmarked in the pension fund. Calculate the payment to the fund and the pension expense. (Enter answers in whole dollar, not In million.) Cash paid Pension expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts