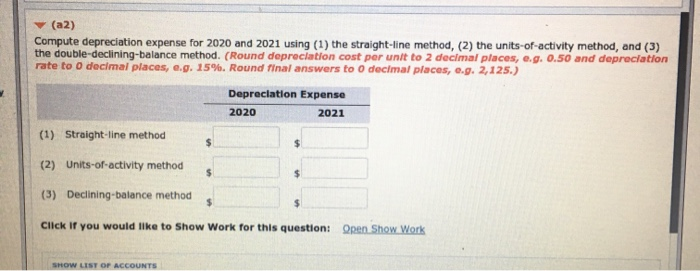

Question: (a2) Compute depreciation expense for 2020 and 2021 using (1) the straight-line method, (2) the units-of-activity method, and (3) the double-declining-balance method. (Round depreciation cost

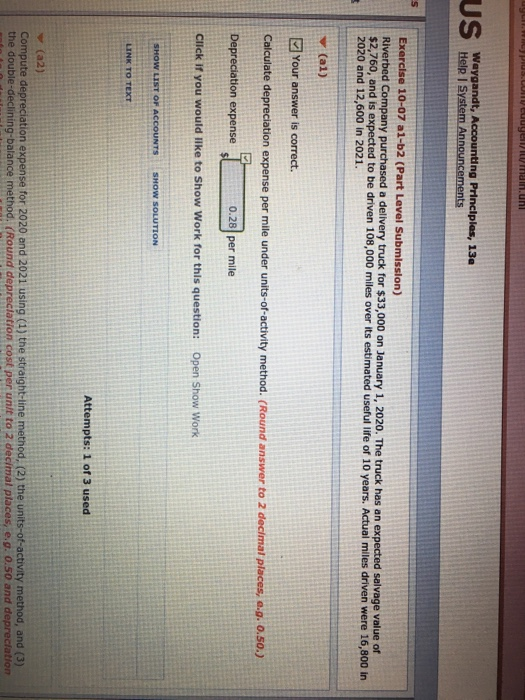

(a2) Compute depreciation expense for 2020 and 2021 using (1) the straight-line method, (2) the units-of-activity method, and (3) the double-declining-balance method. (Round depreciation cost per unit to 2 decimal places, e.g. 0.50 and depreciation rate to o decimal places, e.g. 15%. Round final answers to o decimal places, c.9. 2,125.) Depreciation Expense 2020 2021 (1) Straight-line method $ (2) Units-of-activity method $ (3) Declining balance method $ $ Click If you would like to show Work for this question: Qen Show Work SHOW LIST OF ACCOUNTS LII. Wpius.LV luuyununl US Waygandt, Accounting Principles, 13a Help System Announcements s Exercise 10-07 a1-62 (Part Level Submission) Riverbed Company purchased a delivery truck for $33,000 on January 1, 2020. The truck has an expected salvage value of $2,760, and is expected to be driven 108,000 miles over its estimated useful life of 10 years. Actual miles driven were 16,800 in 2020 and 12,600 in 2021. (al) Your answer is correct. Calculate depreciation expense per mile under units-of-activity method. (Round answer to 2 decimal places, e.g. 0.50.) Depreciation expense 0.28 per mile Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS SHOW SOLUTION LINK TO TEXT Attempts: 1 of 3 used (2) Compute depreciation expense for 2020 and 2021 using (1) the straight-line method, (2) the units-of-activity method, and (3) the double-declining balance method. (Round depreciation cost per unit to 2 decimal places, e.g. 0.50 and depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts