Question: A.2 Time Series Model Building Divide the series into test set (the last 12 observations of the time series) and training set (the remaining observations

A.2 Time Series Model Building

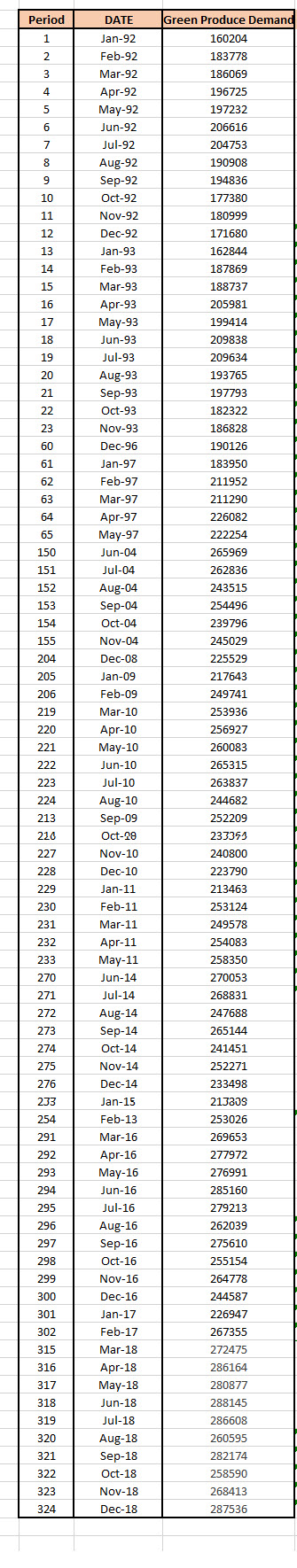

- Divide the series into test set (the last 12 observations of the time series) and training set (the remaining observations of the time series).

- Using the training set, build exactly three contender forecasting models for time series (MA, SES, LES) . Only use those methods taught in this module.

A.3 Time Series Forecasting

- For each of the candidate models estimated, produce a forecast equal to the length of the test set, that is, for h=12 steps ahead. You should have three forecasts in total.

- Calculate the in-sample and out-of-sample forecasting performance using the following metrics:

- Mean error (ME)

- Mean absolute error (MAE)

- Mean squared error (MSE)

- Root mean squared error (RMSE)

- Mean absolute percentage error (MAPE)

A.4 Safety Stock

Using the final best forecast:

- Calculate the expected value of lead-time demand based on lead-time of 12 also equal to the forecast horizon, h=12.

- Calculate the standard deviation of lead-time demand based on lead-time of 12 also equal to the forecast horizon, h=12.

- Calculate the reorder point based on the assumption of a normal distribution of forecast errors, and a stock-out risk of 3% (97% risk cover).

PART B SIMULATION

B.1 Expected Lead Time Demand for a company

Assume that a share of the expected lead-time demand or production belongs to the company. However, there is some uncertainty associated with this share. This can be summarized using the following table:

Share

0.20.30.40.50.60.70.80.9Probability0.050.030.070.10.150.20.250.15

Using simulation and a total of 150 trials, calculate the expected lead-time demand or production achieved by the company.

B.2 Expected Profit for the company

The forecasted units are assumed to have a selling price of 8.00 and a variable cost of production per unit 4.50. Estimate the expected profit obtained by the company.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts