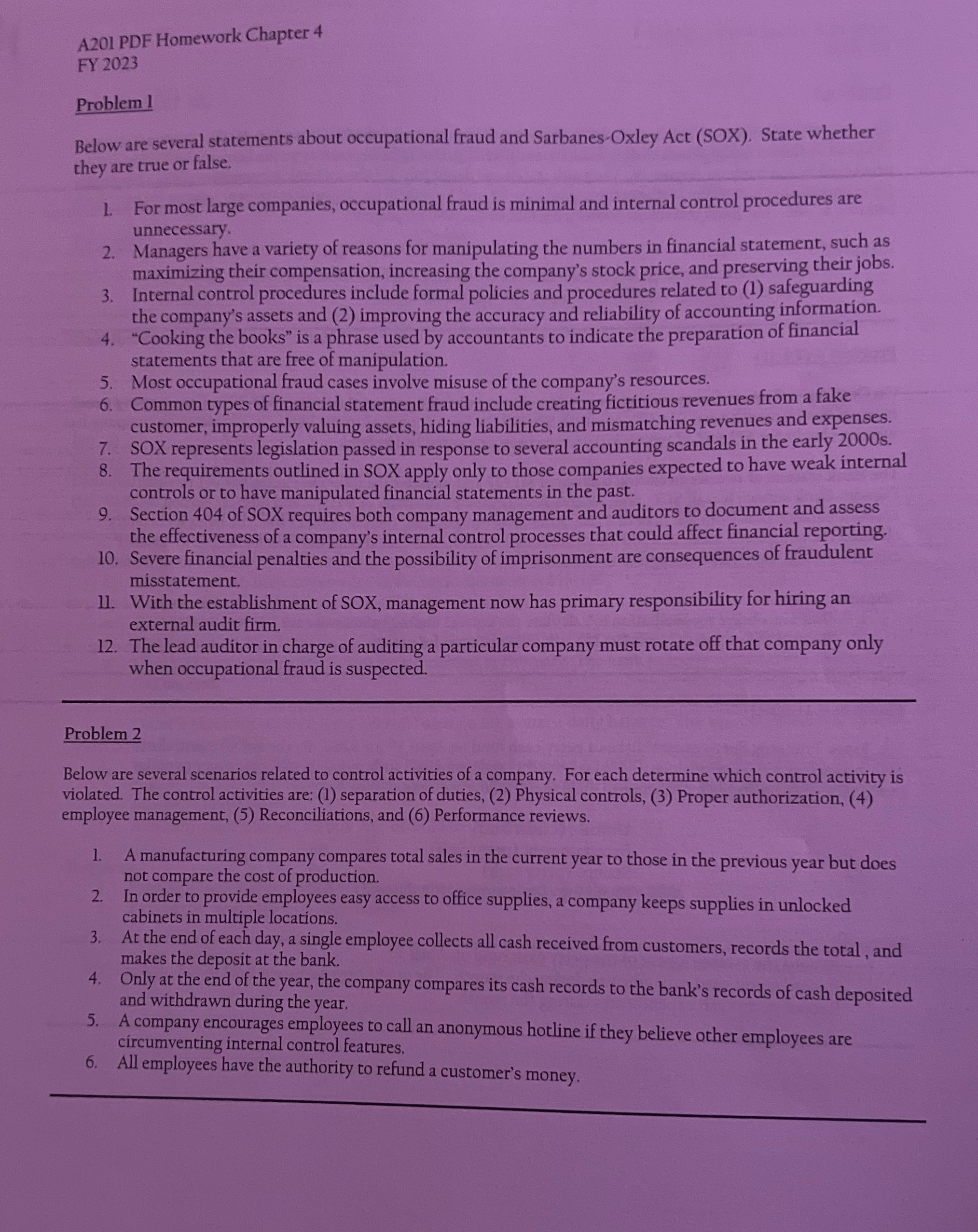

Question: A201 PDF Homework Chapter 4 FY 2023 Problem 1 Below are several statements about occupational fraud and Sarbanes-Oxley Act (SOX). State whether they are true

A201 PDF Homework Chapter 4 FY 2023 Problem 1 Below are several statements about occupational fraud and Sarbanes-Oxley Act (SOX). State whether they are true or false. 1. For most large companies, occupational fraud is minimal and internal control procedures are unnecessary. 2. Managers have a variety of reasons for manipulating the numbers in financial statement, such as maximizing their compensation, increasing the company's stock price, and preserving their jobs. 3. Internal control procedures include formal policies and procedures related to (1) safeguarding the company's assets and (2) improving the accuracy and reliability of accounting information. 4. "Cooking the books" is a phrase used by accountants to indicate the preparation of financial statements that are free of manipulation. 5. Most occupational fraud cases involve misuse of the company's resources. 6. Common types of financial statement fraud include creating fictitious revenues from a fake customer, improperly valuing assets, hiding liabilities, and mismatching revenues and expenses. 7. SOX represents legislation passed in response to several accounting scandals in the early 2000s. 8. The requirements outlined in SOX apply only to those companies expected to have weak internal controls or to have manipulated financial statements in the past. 9. Section 404 of SOX requires both company management and auditors to document and assess the effectiveness of a company's internal control processes that could affect financial reporting. 10. Severe financial penalties and the possibility of imprisonment are consequences of fraudulent misstatement. 11. With the establishment of SOX, management now has primary responsibility for hiring an external audit firm. 12. The lead auditor in charge of auditing a particular company must rotate off that company only when occupational fraud is suspected. Problem 2 Below are several scenarios related to control activities of a company. For each determine which control activity is violated. The control activities are: (1) separation of duties, (2) Physical controls, (3) Proper authorization, (4) employee management, (5) Reconciliations, and (6) Performance reviews. 1. A manufacturing company compares total sales in the current year to those in the previous year but does not compare the cost of production. 2. In order to provide employees easy access to office supplies, a company keeps supplies in unlocked cabinets in multiple locations. 3. At the end of each day, a single employee collects all cash received from customers, records the total , and makes the deposit at the bank. 4, Only at the end of the year, the company compares its cash records to the bank's records of cash deposited and withdrawn during the year. 5. A company encourages employees to call an anonymous hotline if they believe other employees are circumventing internal control features. 6. All employees have the authority to refund a customer's money