Question: A20-9 Basic EPS The Duckworth Ltd. 20X5 financial statements include the following: The company declared and paid preferred dividends of $20,000 during the year and

A20-9 Basic EPS

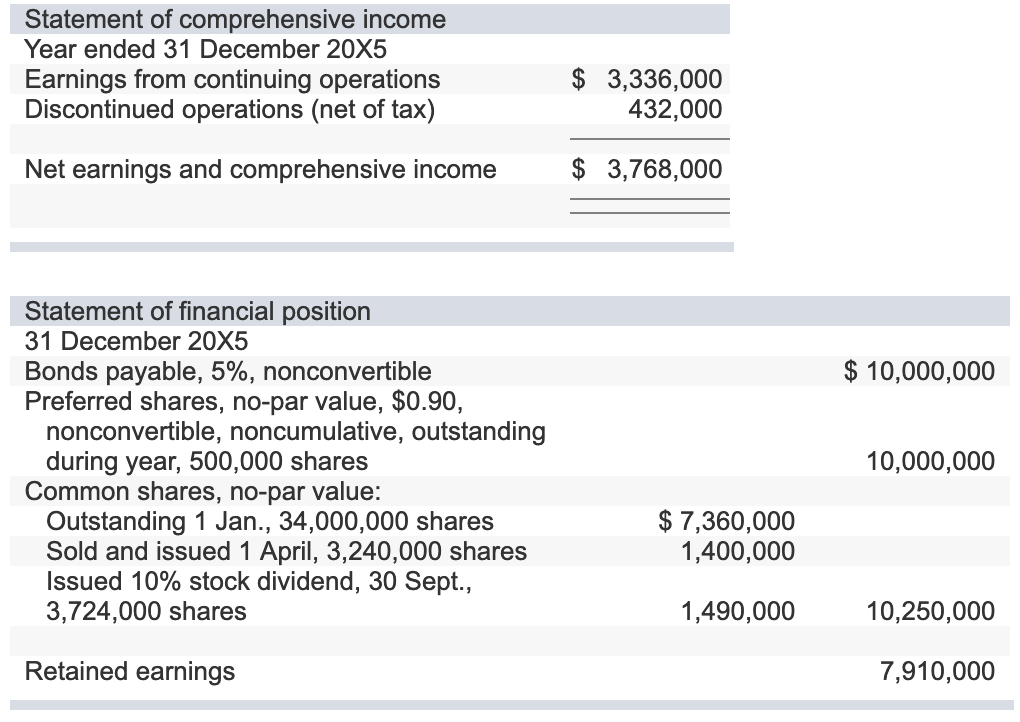

The Duckworth Ltd. 20X5 financial statements include the following:

The company declared and paid preferred dividends of $20,000 during the year and had an effective tax rate of 25%.

Required: 1. Compute basic EPS.

2. Repeat requirement 1, assuming that the preferred shares are cumulative.

Statement of comprehensive income Year ended 31 December 20X5 Earnings from continuing operations Discontinued operations (net of tax) $ 3,336,000 432,000 Net earnings and comprehensive income $ 3,768,000 Statement of financial position 31 December 20X5 Bonds payable, 5%, nonconvertible Preferred shares, no-par value, $0.90, $10,000,000 nonconvertible, noncumulative, outstanding during year, 500,000 shares 10,000,000 Common shares, no-par value: $ 7,360,000 1,400,000 Outstanding 1 Jan., 34,000,000 shares Sold and issued 1 April, 3,240,000 shares Issued 10% stock dividend, 30 Sept 3,724,000 shares 1,490,000 10,250,000 Retained earnings 7,910,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts