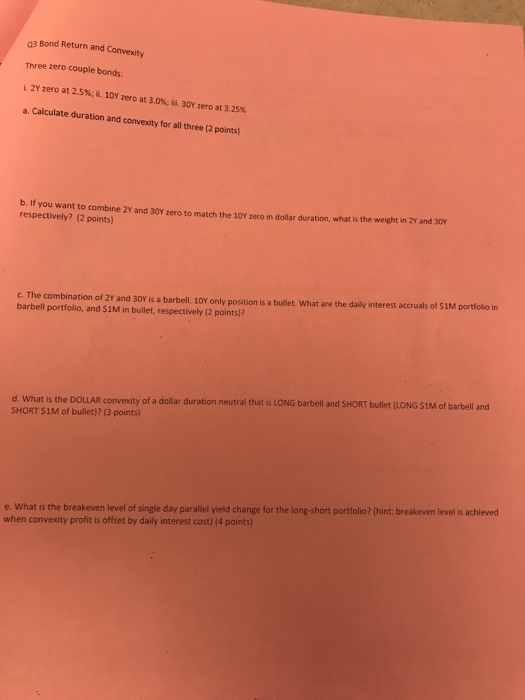

Question: a3 Bond Return and Convexity Three zero couple bonds i. 2Y zero at 2.5%; i. 10Y zero at 3.0%; iii. 30Y zero at 3.25% a.

a3 Bond Return and Convexity Three zero couple bonds i. 2Y zero at 2.5%; i. 10Y zero at 3.0%; iii. 30Y zero at 3.25% a. Calculate duration and convexity for all three (2 points) b. If you want to combine 2Y and 30Y zero to match the 10V zero in dollar duration, what is the weight in 2Y and 30Y respectively? (2 points) c. The combination of 2Y and 30Y is a barbell. 10Y only position is a bullet. What are the daily interest accruals of $1M portfolio in barbell portfolio, and $1M in bullet, respectively (2 points)? d. What is the DOLLAR con exity of a dollar duration neutral that s LONG barbell and S ORT bullet LONG SM of barbell and SHORT SIM of bullet)? (3 points) e. What is the breakeven level of single day paralilel yield change for the long-short portfolio? (hint: breakeven level is achieved when convexity profit is offset by daily interest cost) (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts