Question: A=8 b=5 c=25 QUESTION 1 a) Ali ple has a common stock that paid RO 1 dividend at the end of the last year and

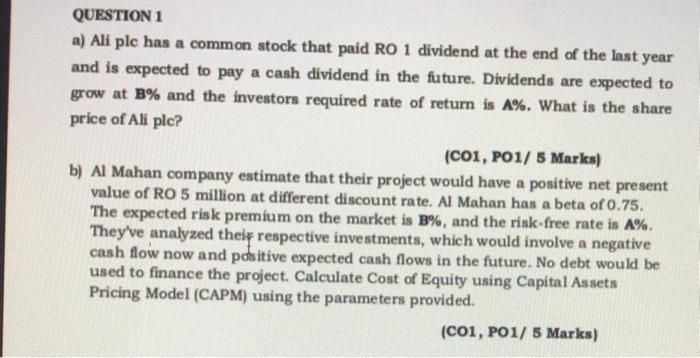

QUESTION 1 a) Ali ple has a common stock that paid RO 1 dividend at the end of the last year and is expected to pay a cash dividend in the future. Dividends are expected to grow at B% and the investors required rate of return is A%. What is the share price of Ali plc? (C01, P01/ 5 Marks) b) Al Mahan company estimate that their project would have a positive net present value of RO 5 million at different discount rate. Al Mahan has a beta of 0.75. The expected risk premium on the market is B%, and the risk-free rate is 1%. They've analyzed their respective investments, which would involve a negative cash flow now and positive expected cash flows in the future. No debt would be used to finance the project. Calculate Cost of Equity using Capital Assets Pricing Model (CAPM) using the parameters provided. (C01, PO1/ 5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts