Question: Aa Aa 3. Reaching a financial goal Tim has decided to retire once he has $2,000,000 in his retirement account. At the end of each

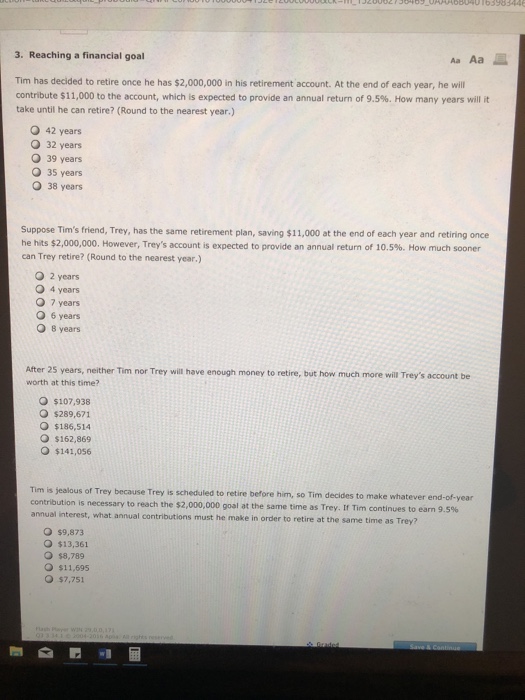

Aa Aa 3. Reaching a financial goal Tim has decided to retire once he has $2,000,000 in his retirement account. At the end of each year, he will contribute $11,000 to the account, which is expected to provide an annual return of 9.5%. How many years will it take until he can retire? (Round to the nearest year.) O 42 years O 32 years O 39 years O 35 years O 38 years Suppose Tim's friend, Trey, has the same retirement plan, saving $11,000 at the end of each year and retiring once he hits $2,000,000. However, Trey's account is expected to provide an annual return of 10.5%. How much sooner can Trey retire? (Round to the nearest year.) O 2 years O 4 years 7 years O 6 years O 8 years After 25 years, neither Tim nor Trey will have enough money to retire, but how much more will Trey's account be worth at this time? O $107,938 O $289,671 O $186,514 O $162,869 O $141,056 Tim is jealous of Trey because Trey is scheduled to retire before him, so Tim decides to make whatever end-of-year is necessary to reach the $2,000,000 goal at the same time as Trey . If Tim continues to earn 9.5% annual interest, what annual contributions must he make in order to retire at the same time as Trey? $9,873 O $13,361 O $8,789 O $11,695 O $7,751

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts