Question: Aa Aa E 5. Constant growth stocks SCI just paid a dividend (Do) of $3.36 per share, and its annual dividend is expected to grow

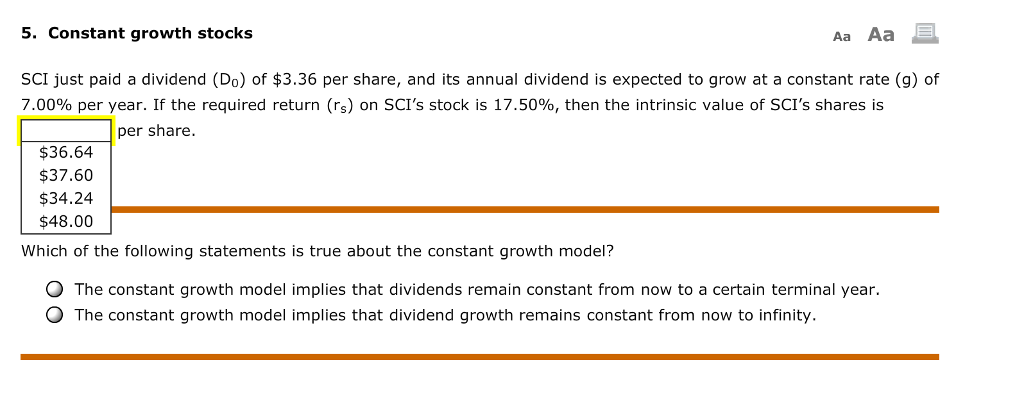

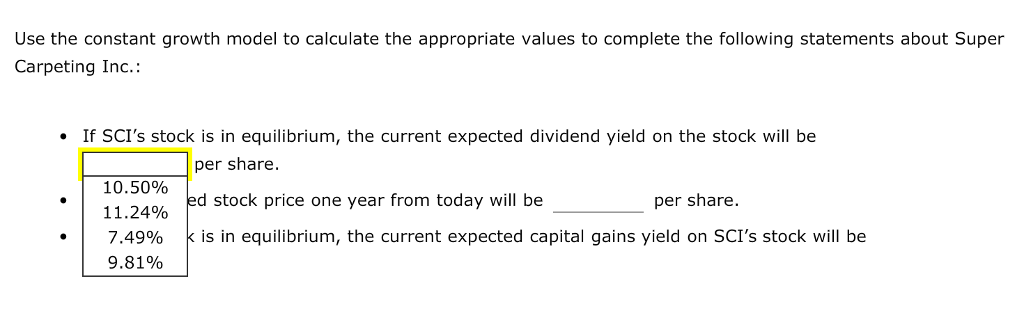

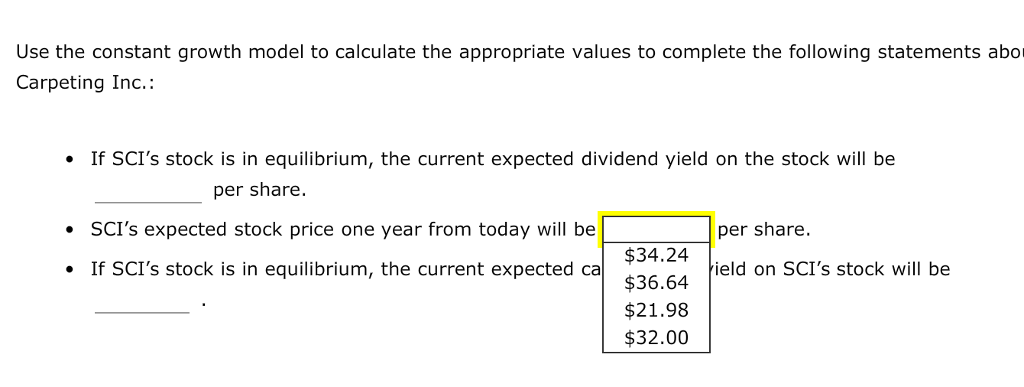

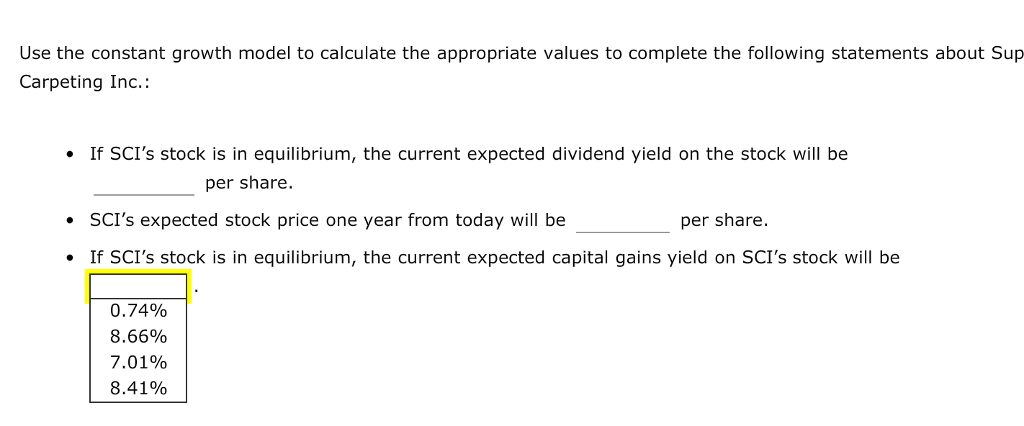

Aa Aa E 5. Constant growth stocks SCI just paid a dividend (Do) of $3.36 per share, and its annual dividend is expected to grow at a constant rate (g) of 7.00% per year. If the required return (rs) on SCI's stock is 17.50%, then the intrinsic value of SCI's shares is per share. $36.64 $37.60 $34.24 $48.00 Which of the following statements is true about the constant growth model? O The constant growth model implies that dividends remain constant from now to a certain terminal year. O The constant growth model implies that dividend growth remains constant from now to infinity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts