Question: Aa- | CD. bct .ay.A 1 Normal 1 No Spac... Heading 1 Heading 2 Title Paragraph Styles 1. Assume you are a loan officer for

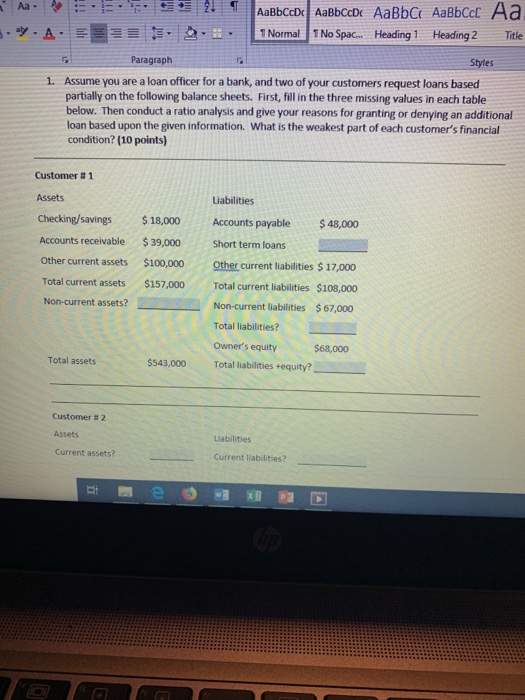

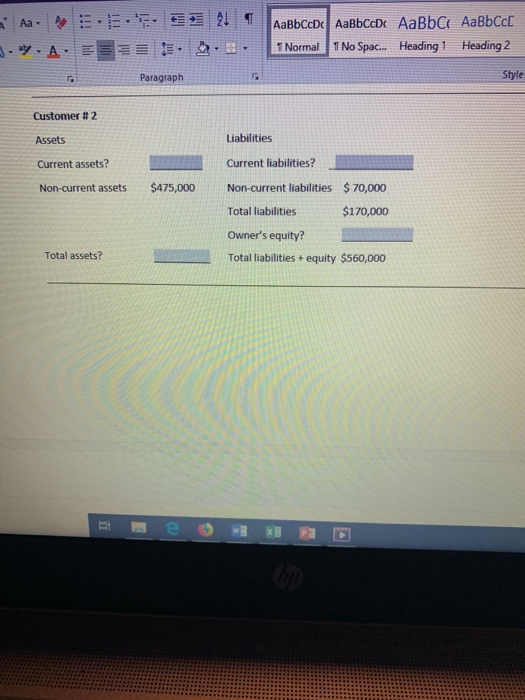

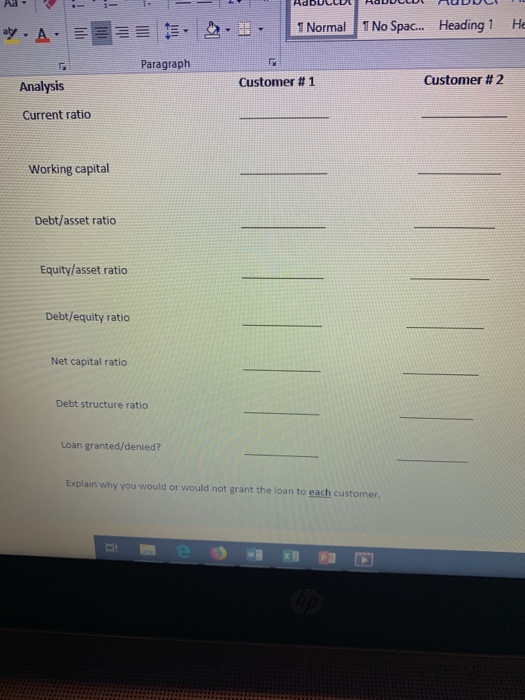

Aa- | CD. bct .ay.A 1 Normal 1 No Spac... Heading 1 Heading 2 Title Paragraph Styles 1. Assume you are a loan officer for a bank, and two of your customers request loans based partially on the following balance sheets. First, fill in the three missing values in each table below. Then conduct a ratio analysis and give your reasons for granting or denying an additional loan based upon the given information. What is the weakest part of each customer's financial condition? (10 points) Customer # 1 Assets Checking/savings Liabilities Accounts payable $ 18,000 $ 48,000 Accounts receivable $ 39,000 Short term loans Other current assets $100,000 Total current assets $157,000 Non-current assets? Other current liabilities $ 17,000 Total current liabilities $108,000 Non-current liabilities $67,000 Total liabilities? Total assets Owner's equity $68,000 Total liabilities equity? $543,000 Customer #2 Assets Liabilities Current assets? Current liabilities? i E 21 A Aa- - ay. A. AaBbCcDc AaBbCcDc AaBbci AaBbcc I Normal 1 No Spac... Heading 1 Heading 2 Paragraph Style Customer #2 Assets Liabilities Current assets? Current liabilities? Non-current assets $475,000 Non-current liabilities $ 70,000 Total liabilities $170,000 Owner's equity? Total liabilities + equity $560,000 Total assets? i 1 Normal He aly - A. 1 No Spac... Heading 1 Paragraph Analysis Customer # 1 Customer #2 Current ratio Working capital Debt/asset ratio Equity/asset ratio Debt/equity ratio Net capital ratio Debt structure ratio Loan granted/denied? Explain why you would or would not grant the loan to each customer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts