Question: AAA Hardware uses the LIFO method to report its inventory. Inventory at the beginning of the year consisted of 21,000 units of the company's

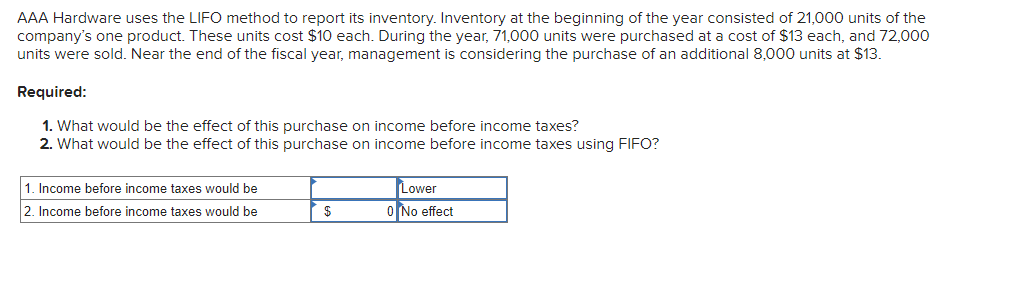

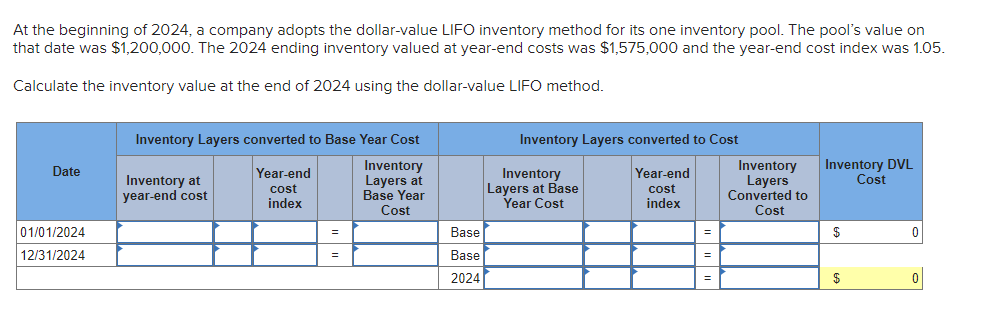

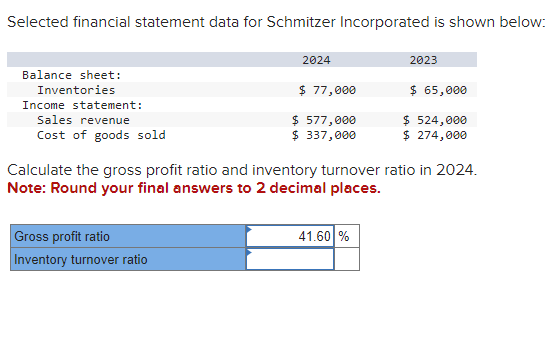

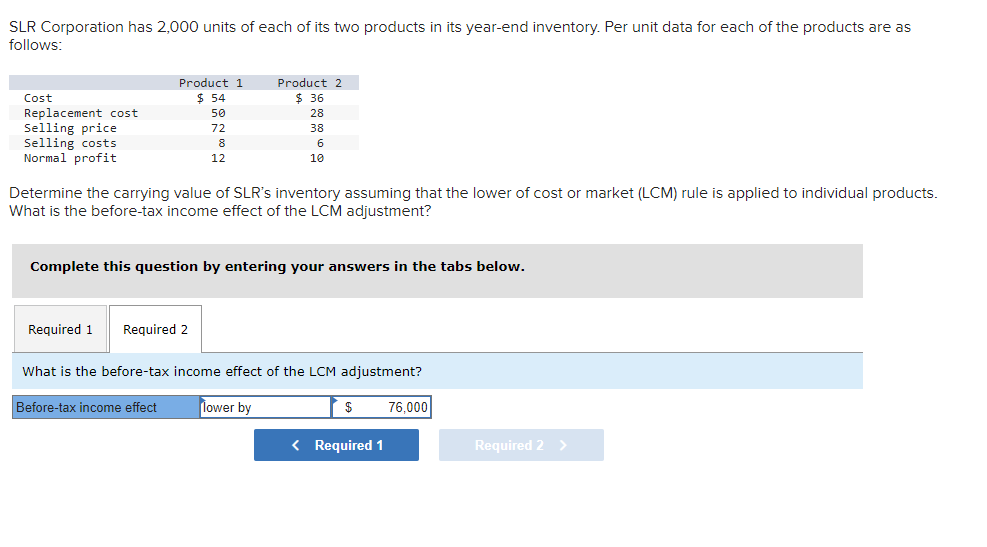

AAA Hardware uses the LIFO method to report its inventory. Inventory at the beginning of the year consisted of 21,000 units of the company's one product. These units cost $10 each. During the year, 71,000 units were purchased at a cost of $13 each, and 72,000 units were sold. Near the end of the fiscal year, management is considering the purchase of an additional 8,000 units at $13. Required: 1. What would be the effect of this purchase on income before income taxes? 2. What would be the effect of this purchase on income before income taxes using FIFO? 1. Income before income taxes would be 2. Income before income taxes would be Lower 0 No effect At the beginning of 2024, a company adopts the dollar-value LIFO inventory method for its one inventory pool. The pool's value on that date was $1,200,000. The 2024 ending inventory valued at year-end costs was $1,575,000 and the year-end cost index was 1.05. Calculate the inventory value at the end of 2024 using the dollar-value LIFO method. Inventory Layers converted to Base Year Cost Date Inventory at year-end cost Year-end cost index 01/01/2024 12/31/2024 = = Inventory Layers converted to Cost Inventory Layers at Base Year Cost Inventory Layers at Base Year-end Year Cost cost index Inventory Layers Converted to Inventory DVL Cost Cost Base $ 0 Base = 2024 $ 0 Selected financial statement data for Schmitzer Incorporated is shown below: Balance sheet: Inventories Income statement: Sales revenue Cost of goods sold 2024 2023 $ 77,000 $ 65,000 $ 577,000 $ 524,000 $ 337,000 $ 274,000 Calculate the gross profit ratio and inventory turnover ratio in 2024. Note: Round your final answers to 2 decimal places. Gross profit ratio Inventory turnover ratio 41.60% SLR Corporation has 2,000 units of each of its two products in its year-end inventory. Per unit data for each of the products are as follows: Cost Replacement cost Selling price Selling costs Product 1 Product 2 $ 54 $ 36 50 28 72 8 12 38 6 10 Normal profit Determine the carrying value of SLR's inventory assuming that the lower of cost or market (LCM) rule is applied to individual products. What is the before-tax income effect of the LCM adjustment? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the before-tax income effect of the LCM adjustment? Before-tax income effect lower by $ 76,000 < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts