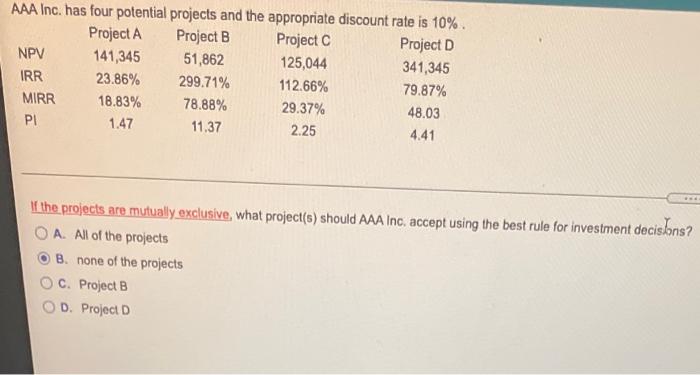

Question: AAA Inc. has four potential projects and the appropriate discount rate is 10%. Project A Project B Project C Project D NPV 141,345 51,862 125,044

AAA Inc. has four potential projects and the appropriate discount rate is 10%. Project A Project B Project C Project D NPV 141,345 51,862 125,044 341,345 IRR 23.86% 299.71% 112.66% 79.87% MIRR 18.83% 78.88% 29.37% 48.03 PI 1.47 11.37 2.25 4.41 If the projects are mutually exclusive, what project(s) should AAA Inc. accept using the best rule for investment decisions? A. All of the projects B. none of the projects OC. Project B OD. Project D

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock