Question: AaBb Cc AaBbCcDdI AaBbCeDdl AaBb Heading 1 Heading 2 Heading 3 Heading 4 On May 11, Gradner Company sold $30,000 of merchandise to Dionne Company,

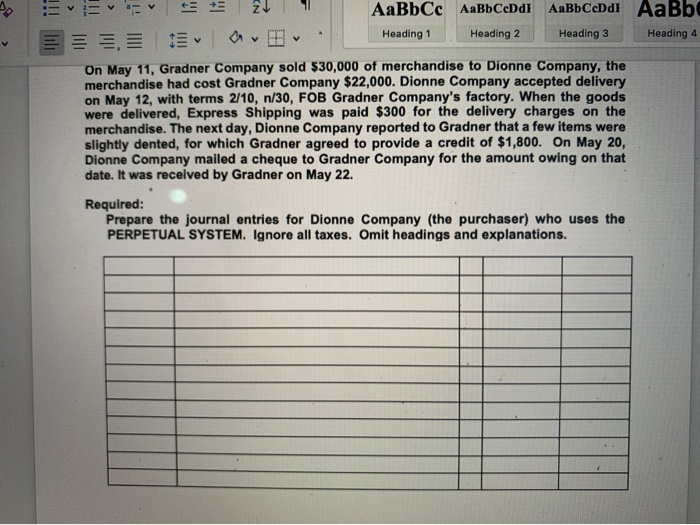

AaBb Cc AaBbCcDdI AaBbCeDdl AaBb Heading 1 Heading 2 Heading 3 Heading 4 On May 11, Gradner Company sold $30,000 of merchandise to Dionne Company, the merchandise had cost Gradner Company $22,000. Dionne Company accepted delivery on May 12, with terms 2/10, n/30, FOB Gradner Company's factory. When the goods were delivered, Express Shipping was paid $300 for the delivery charges on the merchandise. The next day, Dionne Company reported to Gradner that a few items were slightly dented, for which Gradner agreed to provide a credit of $1,800. On May 20, Dionne Company mailed a cheque to Gradner Company for the amount owing on that date. It was received by Gradner on May 22. Required: Prepare the journal entries for Dionne Company (the purchaser) who uses the PERPETUAL SYSTEM. Ignore all taxes. Omit headings and explanations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts