Question: AaBb Cebdo - A PO EEVEE E 21 DA AaBbcode Normal AaBbCcDc AaBbcode Heading 1 Heading 2 No Spacing Assume that a radiologist group practice

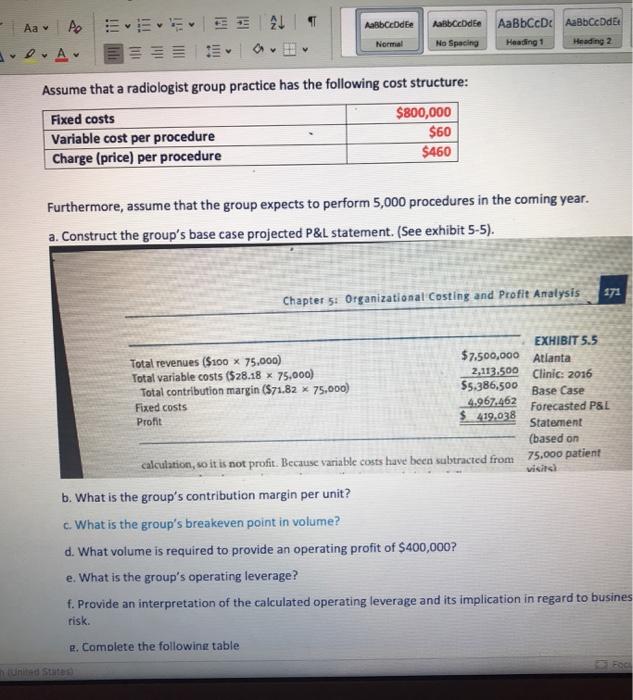

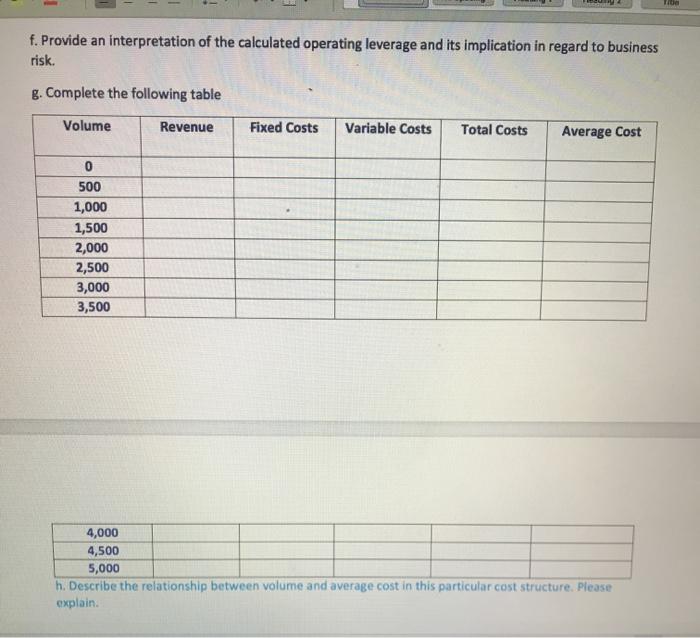

AaBb Cebdo - A PO EEVEE E 21 DA AaBbcode Normal AaBbCcDc AaBbcode Heading 1 Heading 2 No Spacing Assume that a radiologist group practice has the following cost structure: Fixed costs $800,000 Variable cost per procedure Charge (price) per procedure $460 $60 Furthermore, assume that the group expects to perform 5,000 procedures in the coming year. a. Construct the group's base case projected P&L statement. (See exhibit 5-5). 171 Chapter 5: Organizational Costing and Profit Analysis EXHIBIT 5.5 Total revenues ($100 x 75,000) $7,500,000 Atlanta Total variable costs ($28.18 x 75.000) 2,113.500 Clinic: 2016 Total contribution margin ($71.82 x 75,000) $5,386,500 Base Case Fixed costs 4.967.462 Forecasted P&L Profit $ 419,038 Statement (based on calculation, so it is not profit. Because variable costs have been subtracted from 75.000 patient visits b. What is the group's contribution margin per unit? c. What is the group's breakeven point in volume? d. What volume is required to provide an operating profit of $400,000? e. What is the group's operating leverage? f. Provide an interpretation of the calculated operating leverage and its implication in regard to busines risk. 2. Complete the following table f. Provide an interpretation of the calculated operating leverage and its implication in regard to business risk. g. Complete the following table Volume Revenue Fixed Costs Variable Costs Total Costs Average Cost 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 h. Describe the relationship between volume and average cost in this particular cost structure. Please explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts