Question: AaBbca Albad AaBbCcDAoBbcode AaBbCcDE ARD Norma No Spacing Heading 1 Tide Suite (4 marks) b) You are considering investing in Stock A and your broker

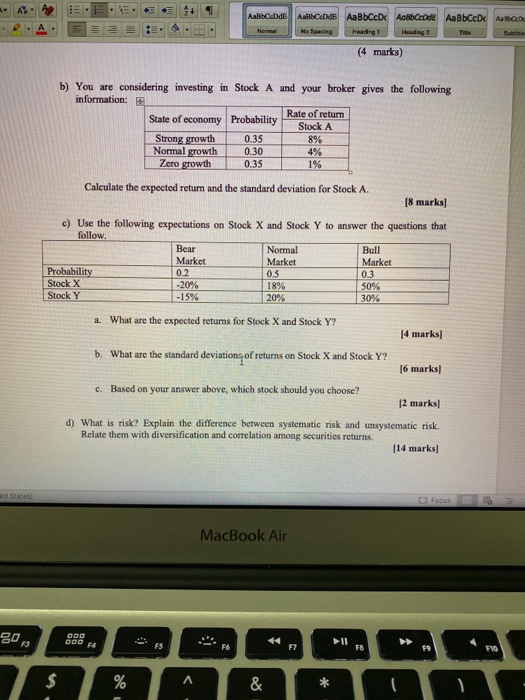

AaBbca Albad AaBbCcDAoBbcode AaBbCcDE ARD Norma No Spacing Heading 1 Tide Suite (4 marks) b) You are considering investing in Stock A and your broker gives the following information: Rate of return State of economy Probability Stock A Strong growth 0.35 8% Normal growth 0.30 4% Zero growth 0.35 1% Calculate the expected return and the standard deviation for Stock A. [8 marks) c) Use the following expectations on Stock X and Stock Y to answer the questions that follow Bear Normal Bull Market Market Market Probability 0.2 0.5 Stock X -20% 18% 50% Stock Y -15% 20% 30% 0.3 a. What are the expected returns for Stock X and Stock Y? [4 marks b. What are the standard deviations of returns on Stock X and Stock Y? [6 marks C. Based on your answer above, which stock should you choose? [2 marks d) What is risk? Explain the difference between systematic risk and unsystematic risk Relate them with diversification and correlation among securities returns [14 marks) od States Focus MacBook Air 20 ODO 000 4 FS FO F7 FB FVO $ % A so

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts