Question: Aabbcc de Aalboede AaBbCcD AaBbCcDde EEL 1 Normal No Spacing Heading 1 Heading 2 6 2. Based on the following financial statements, compute the following

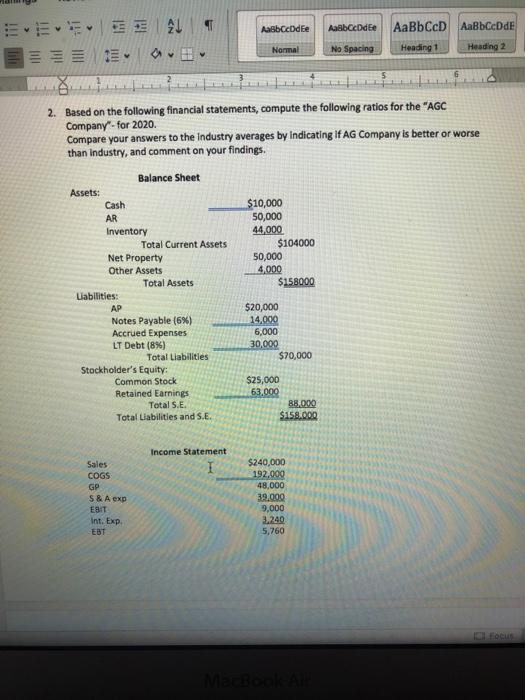

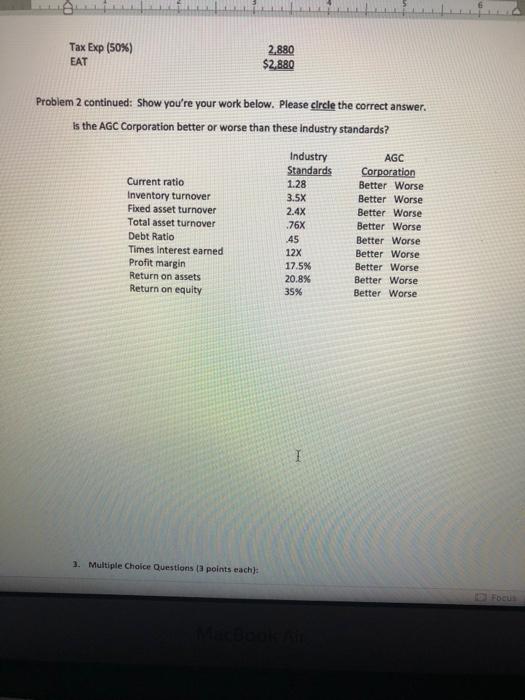

Aabbcc de Aalboede AaBbCcD AaBbCcDde EEL 1 Normal No Spacing Heading 1 Heading 2 6 2. Based on the following financial statements, compute the following ratios for the "AGC Company for 2020 Compare your answers to the Industry averages by indicating if AG Company is better or worse than Industry, and comment on your findings. $10,000 50,000 44,000 $104000 50,000 4.000 $158000 Balance Sheet Assets: Cash AR Inventory Total Current Assets Net Property Other Assets Total Assets Labilities: AP Notes Payable (6%) Accrued Expenses LT Debt (8%) Total Liabilities Stockholder's Equity: Common Stock Retained Earnings Total S.E Total Liabilities and S.E. $20,000 14.000 6,000 30,000 $70,000 $25,000 63,000 88.000 $158.000 Income Statement Sales COGS GP $ & A exp ESIT Int. Exp. EBT $240,000 192,000 48.000 39.000 9,000 3.240 5,760 MacBook Tax Exp (50%) EAT 2.880 $2,880 Problem 2 continued: Show you're your work below. Please clrcle the correct answer. Is the AGC Corporation better or worse than these Industry standards? Industry AGC Standards Corporation Current ratio 1.28 Better Worse Inventory turnover 3.5X Better Worse Fixed asset turnover 2.4X Better Worse Total asset turnover .76X Better Worse Debt Ratio .45 Better Worse Times Interest earned 12x Better Worse Profit margin 17.5% Better Worse Return on assets 20.8% Better Worse Return on equity 35% Better Worse 7 3. Multiple Choice Questions points each)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts