Question: AaBbccd AaBbced AaBbc Aabbccc AaB Y Normal 1 No Spac... Heading 1 Heading 2 Title Paragraph Styles Lovepop Case Questions Please answer the following questions

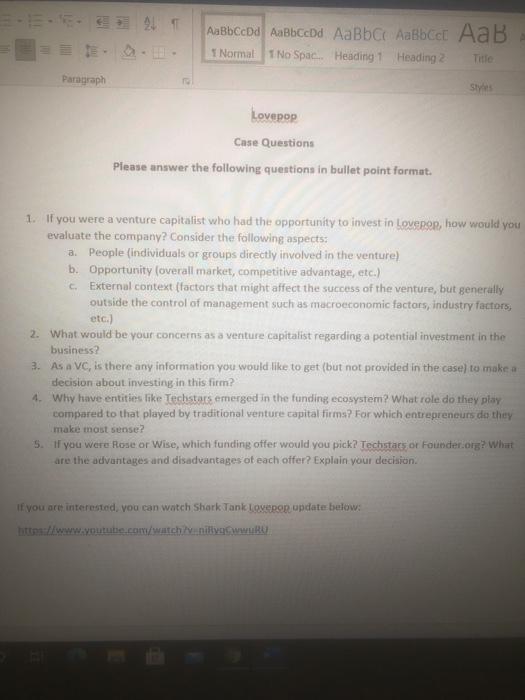

AaBbccd AaBbced AaBbc Aabbccc AaB Y Normal 1 No Spac... Heading 1 Heading 2 Title Paragraph Styles Lovepop Case Questions Please answer the following questions in bullet point format. 1. If you were a venture capitalist who had the opportunity to invest in Loverer, how would you evaluate the company? Consider the following aspects: a. People (individuals or groups directly involved in the venture) b. Opportunity (overall market, competitive advantage, etc.) c. External context (factors that might affect the success of the venture, but generally outside the control of management such as macroeconomic factors, industry factors, etc.) 2. What would be your concerns as a venture capitalist regarding a potential investment in the business? 3. As a vc, is there any information you would like to get (but not provided in the case) to make a decision about investing in this fie? 4. Why have entities like Techstars emerged in the funding ecosystem? What role do they play compared to that played by traditional venture capital firms? For which entrepreneurs do they make most sense? 5. If you were Rose or Wise, which funding offer would you pick? Techstars or Founder.org? What are the advantages and disadvantages of each offer? Explain your decision If you are interested, you can watch Shark Tank Lovepop update below: httwww.youtube.com/watch/v na ww AaBbccd AaBbced AaBbc Aabbccc AaB Y Normal 1 No Spac... Heading 1 Heading 2 Title Paragraph Styles Lovepop Case Questions Please answer the following questions in bullet point format. 1. If you were a venture capitalist who had the opportunity to invest in Loverer, how would you evaluate the company? Consider the following aspects: a. People (individuals or groups directly involved in the venture) b. Opportunity (overall market, competitive advantage, etc.) c. External context (factors that might affect the success of the venture, but generally outside the control of management such as macroeconomic factors, industry factors, etc.) 2. What would be your concerns as a venture capitalist regarding a potential investment in the business? 3. As a vc, is there any information you would like to get (but not provided in the case) to make a decision about investing in this fie? 4. Why have entities like Techstars emerged in the funding ecosystem? What role do they play compared to that played by traditional venture capital firms? For which entrepreneurs do they make most sense? 5. If you were Rose or Wise, which funding offer would you pick? Techstars or Founder.org? What are the advantages and disadvantages of each offer? Explain your decision If you are interested, you can watch Shark Tank Lovepop update below: httwww.youtube.com/watch/v na ww

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts