Question: AaBbCcD AaBbCeDdE A BbCeDdi AaBbo Str Sub Why would a corporation issue a bond (rather than stock)? 7-2 Key Characteristics of Bonds Briefly explain the

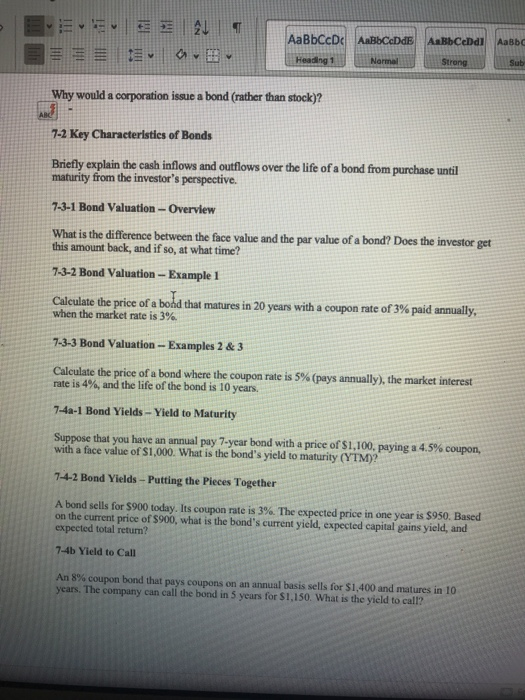

AaBbCcD AaBbCeDdE A BbCeDdi AaBbo Str Sub Why would a corporation issue a bond (rather than stock)? 7-2 Key Characteristics of Bonds Briefly explain the cash inflows and outflows over the life of a bond from purchase until maturity from the investor's perspective. 7-3-1 Bond Valuation- Overview What is the difference between the face value and the par value of a bond? Does the investor get this amount back, and if so, at what time? 7-3-2 Bond Valuation-Example 1 Calculate the price of a bond that matures in 20 years with a coupon rate of 3% paid annually when the market rate is 3%. 7-3-3 Bond Valuation- Examples 2 &3 Calculate the price of a bond where the coupon rate is 5% (pays annually), the market interest rate is 4%, and the life of the bond is 10 years. 7-4a-1 Bond Yields- Yield to Maturity Suppose that you have an annual pay 7-year bond with a price of S 1,100, paying a 4.5% coupon, with a face value of $1,000. What is the bond's yield to maturity (YTM)? 7-4-2 Bond Yields- Putting the Pieces Together A bond sells for S900 today. Its coupon rate is 3%. The expected price in one year is Sosa Based on the current price of $900, what is the bond's current yield, expected capital gains yield, and expected total return? 7-4b Yield to Call An 8% coupon bond that pays coupons on an annual basis sells for $1,400 and matures in O years. The company can call the bond in 5 years for S1,150. What is the yield to call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts