Question: AaBbCcDd AaBbCcDd AaBCC 1 Normal 1 No Spac... Heading 1 Font Paragraph Styles The most recently paid dividend by Bridges & Associates was $0.625 per

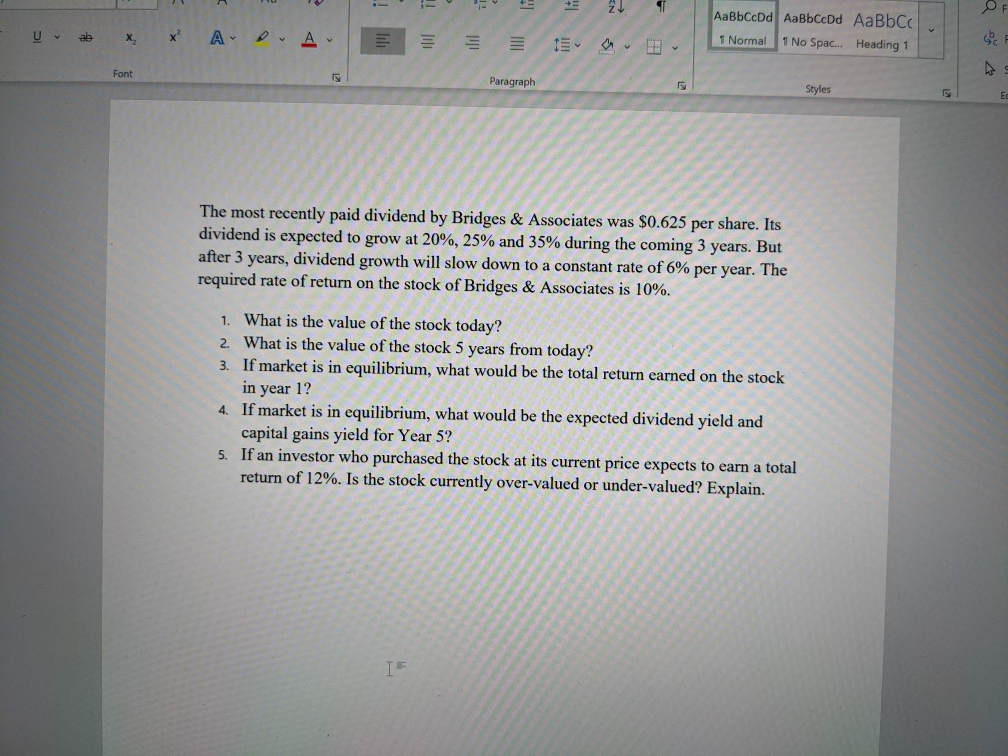

AaBbCcDd AaBbCcDd AaBCC 1 Normal 1 No Spac... Heading 1 Font Paragraph Styles The most recently paid dividend by Bridges & Associates was $0.625 per share. Its dividend is expected to grow at 20%, 25% and 35% during the coming 3 years. But after 3 years, dividend growth will slow down to a constant rate of 6% per year. The required rate of return on the stock of Bridges & Associates is 10%. 1. What is the value of the stock today? 2. What is the value of the stock 5 years from today? 3. If market is in equilibrium, what would be the total return earned on the stock in year 1? 4. If market is in equilibrium, what would be the expected dividend yield and capital gains yield for Year 5? 5. If an investor who purchased the stock at its current price expects to earn a total return of 12%. Is the stock currently over-valued or under-valued? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts