Question: AaBbCcDdE AaBbCcDdE AaBb CcDdE AaBb Heading 1 Heading 2 Heading 3 Hear Problem 7-2B (This problem is NOT in your textbook) Halg Company maintains a

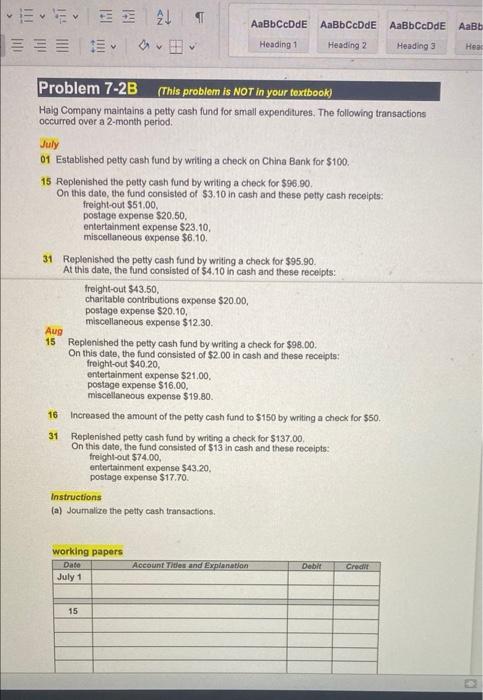

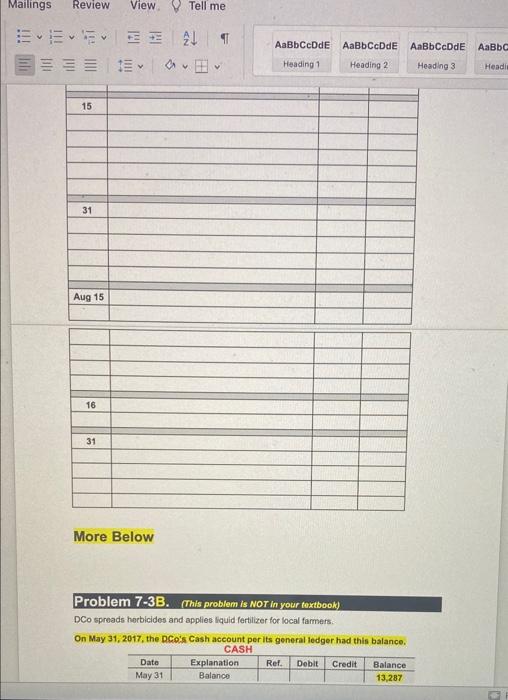

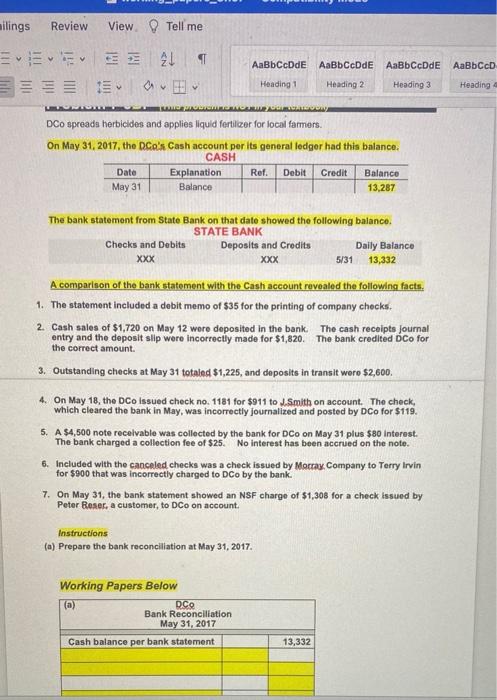

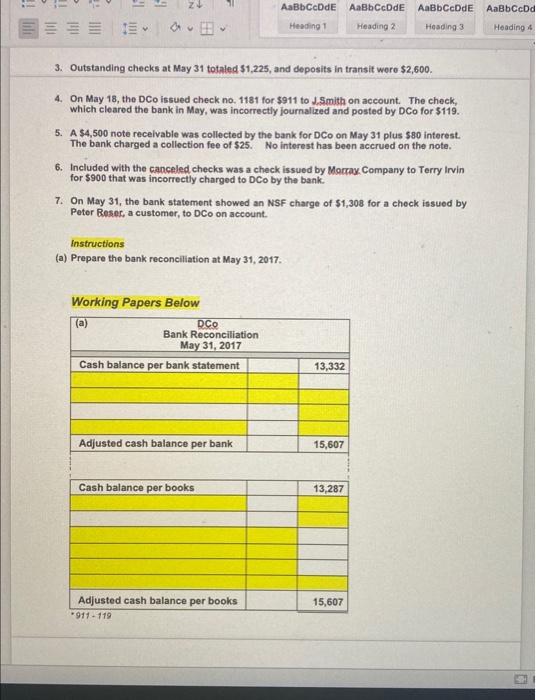

AaBbCcDdE AaBbCcDdE AaBb CcDdE AaBb Heading 1 Heading 2 Heading 3 Hear Problem 7-2B (This problem is NOT in your textbook) Halg Company maintains a petty cash fund for small expenditures. The following transactions occurred over a 2-month period. July 01 Established petty cash fund by writing a check on China Bank for $100. 15 Replenished the petty cash fund by writing a check for $96.90. On this date the fund consisted of $3,10 in cash and these potty cash receipts: freight-out $51.00, postage expense $20,50, entertainment expense $23.10. miscellaneous expense $6.10. 31 Replenished the petty cash fund by writing a check for $95.90. At this date, the fund consisted of $4.10 in cash and these receipts: freight-out $43.50. charitable contributions expense $20.00, postage expense $20.10, miscellaneous expense $12.30 Aug 15 Replenished the petty cash fund by writing a check for $98.00 On this date, the fund consisted of $2.00 in cash and these receipts: freight-out $40.20, entertainment expense S21.00 postage expense $16.00, miscellaneous expense $19.80 16 Increased the amount of the petty cash fund to $150 by writing a check for $50, 31 Replenished petty cash fund by writing a check for $137.00 On this date, the fund consisted of $13 in cash and these receipts: freight-out $74.00, entertainment expense $43.20. postage expense $17.70 Instructions (a) Joumalize the petty cash transactions working papers Date July 1 Account Titles and Explanation Debit Cred 15 Mailings Review View Tell me AL AaBbCcDdE AaBbCcDdE AaBb CcDdE AaBbc v v Heading 1 Heading 2 Heading 3 Headi 15 31 Aug 15 16 31 More Below Problem 7-3B. (This problem is NOT in your textbook) DCo spreads herbicides and applies liquid fertilizer for local farmers On May 31, 2017, the Dcos Cash account per its general ledger had this balance. CASH Date Explanation Ref. Debit Credit Balance May 31 Balance 13,287 nilings Review View Tell me v AaBbCcDdE AaBbCcD , =v= 21 AaBbCcDdE AaBbCcDdE Me Heading 1 Heading 2 UUDIO DCo spreads herbicides and applies liquid fertilizer for local farmers. Heading 3 Heading On May 31, 2017, the DC's Cash account per its general ledger had this balance. CASH Date Explanation Ref. Debit Credit Balance May 31 Balance 13,287 The bank statement from State Bank on that date showed the following balance. STATE BANK Checks and Debits Deposits and Credits Daily Balance XXX XXX 5/31 13,332 A comparison of the bank statement with the Cash account revealed the following facts. 1. The statement included a debit memo of $35 for the printing of company checks 2. Cash sales of $1,720 on May 12 were deposited in the bank. The cash receipts Journal entry and the deposit slip were incorrectly made for $1,820. The bank credited Dco for the correct amount. 3. Outstanding checks at May 31 totaled $1,225, and deposits in transit were $2,600. 4. On May 18, the DCO issued check no. 1181 for $911 to J.Smith on account. The check, which cleared the bank in May, was incorrectly Journalized and posted by DCo for $119. 5. A $4,500 note receivable was collected by the bank for DCo on May 31 plus $80 interest. The bank charged a collection fee of $25. No interest has been accrued on the note. 6. Included with the canceled checks was a check issued by Moctay. Company to Terry Irvin for $900 that was incorrectly charged to DCo by the bank. 7. On May 31, the bank statement showed an NSF charge of 51,308 for a check issued by Peter Roser, a customer, to DCo on account. Instructions (a) Prepare the bank reconciliation at May 31, 2017. Working Papers Below (a) DCO Bank Reconciliation May 31, 2017 Cash balance per bank statement 13,332 z AaBb CcDdE AaBbCcDdE AaBbccdd AaBb CcDdE Heading 1 Heading 2 Heading 3 Heading 4 3. Outstanding checks at May 31 totaled $1,225, and deposits in transit wore $2,600. 4. On May 18, the DCo issued check no. 1181 for $911 to J.Smith on account. The check, which cleared the bank in May, was incorrectly journalized and posted by Dco for $119. 5. A $4,500 note receivable was collected by the bank for DCo on May 31 plus $80 interest. The bank charged a collection fee of $25. No interest has been accrued on the note. 6. Included with the canceled checks was a check issued by Morta. Company to Terry Irvin for $900 that was incorrectly charged to DCo by the bank. 7. On May 31, the bank statement showed an NSF charge of $1,308 for a check issued by Peter Boxer, a customer, to DCo on account. Instructions (a) Prepare the bank reconciliation at May 31, 2017. Working Papers Below (a) DCO Bank Reconciliation May 31, 2017 Cash balance per bank statement 13,332 Adjusted cash balance per bank 15,607 Cash balance per books 13,287 Adjusted cash balance per books 911 - 119 15,607

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts