Question: AaBbCcDdE AaBbCcDdE Normal No Spacing Heading 1 Heading 2 Styles Pane | Tax 5 9 9 Memorandum 1 A and B are married and file

AaBbCcDdE

AaBbCcDdE

Normal

No Spacing

Heading

Heading

Styles

Pane

Tax

Memorandum

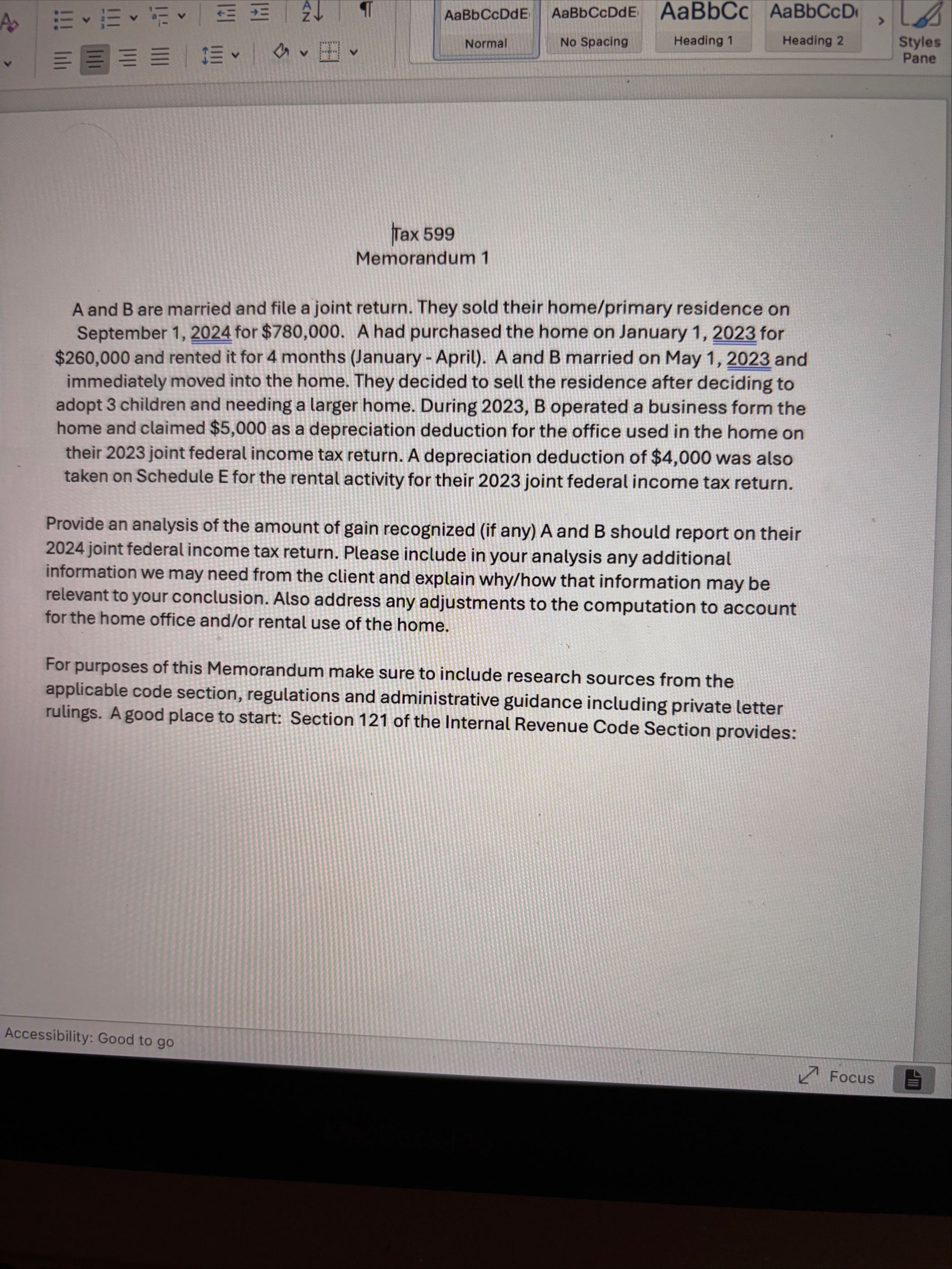

A and are married and file a joint return. They sold their homeprimary residence on September for $ A had purchased the home on January for $ and rented it for months January April A and B married on May and immediately moved into the home. They decided to sell the residence after deciding to adopt children and needing a larger home. During B operated a business form the home and claimed $ as a depreciation deduction for the office used in the home on their joint federal income tax return. A depreciation deduction of $ was also taken on Schedule E for the rental activity for their joint federal income tax return.

Provide an analysis of the amount of gain recognized if any A and should report on their joint federal income tax return. Please include in your analysis any additional information we may need from the client and explain whyhow that information may be relevant to your conclusion. Also address any adjustments to the computation to account for the home office andor rental use of the home.

For purposes of this Memorandum make sure to include research sources from the applicable code section, regulations and administrative guidance including private letter rulings. A good place to start: Section of the Internal Revenue Code Section provides:

Accessibility: Good to go

Focus

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock