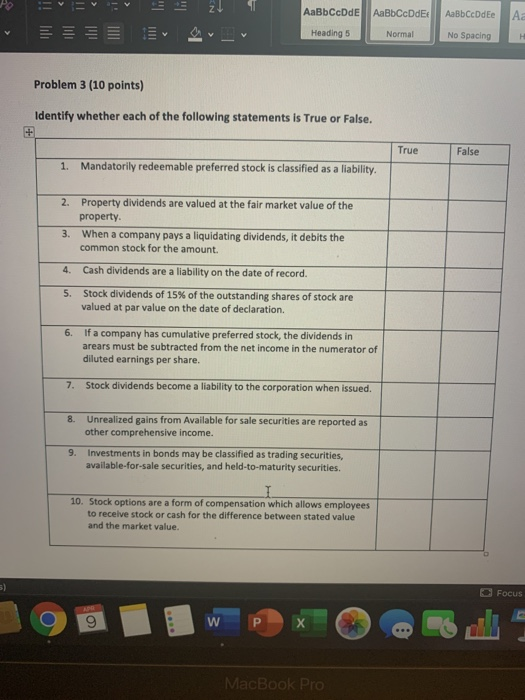

Question: AaBbCcDdE AaBbCcDdEe AaBbCcDdEt Normal Heading 5 No Spacing Problem 3 (10 points) Identify whether each of the following statements is True or False. True False

AaBbCcDdE AaBbCcDdEe AaBbCcDdEt Normal Heading 5 No Spacing Problem 3 (10 points) Identify whether each of the following statements is True or False. True False 1. Mandatorily redeemable preferred stock is classified as a liability 2. Property dividends are valued at the fair market value of the property. 3. When a company pays a liquidating dividends, it debits the common stock for the amount. 4. Cash dividends are a liability on the date of record 5. Stock dividends of 15% of the outstanding shares of stock are valued at par value on the date of declaration. 6. If a company has cumulative preferred stock, the dividends in arears must be subtracted from the net income in the numerator of diluted earnings per share. 7. Stock dividends become a liability to the corporation when issued. 8. Unrealized gains from Available for sale securities are reported as other comprehensive income. 9. Investments in bonds may be classified as trading securities, available for sale securities, and held-to-maturity securities. 10. Stock options are a form of compensation which allows employees to receive stock or cash for the difference between stated value and the market value. AaBbCcDdE AaBbCcDdEe AaBbCcDdEt Normal Heading 5 No Spacing Problem 3 (10 points) Identify whether each of the following statements is True or False. True False 1. Mandatorily redeemable preferred stock is classified as a liability 2. Property dividends are valued at the fair market value of the property. 3. When a company pays a liquidating dividends, it debits the common stock for the amount. 4. Cash dividends are a liability on the date of record 5. Stock dividends of 15% of the outstanding shares of stock are valued at par value on the date of declaration. 6. If a company has cumulative preferred stock, the dividends in arears must be subtracted from the net income in the numerator of diluted earnings per share. 7. Stock dividends become a liability to the corporation when issued. 8. Unrealized gains from Available for sale securities are reported as other comprehensive income. 9. Investments in bonds may be classified as trading securities, available for sale securities, and held-to-maturity securities. 10. Stock options are a form of compensation which allows employees to receive stock or cash for the difference between stated value and the market value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts