Question: AaBbCcDdEe AaBbCcDdEe AaBbCcDd Heading 1 Normal No Spacing Hea 3. Suppose you purchase one ounce of gold on December 31, 2019 at $1400 and sell

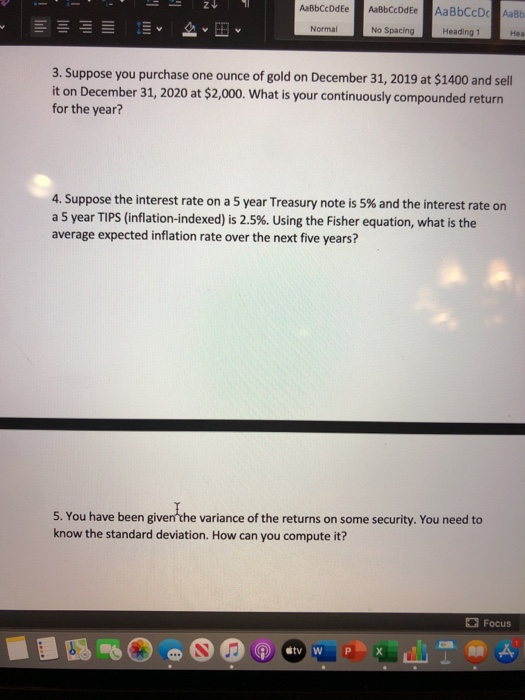

AaBbCcDdEe AaBbCcDdEe AaBbCcDd Heading 1 Normal No Spacing Hea 3. Suppose you purchase one ounce of gold on December 31, 2019 at $1400 and sell it on December 31, 2020 at $2,000. What is your continuously compounded return for the year? 4. Suppose the interest rate on a 5 year Treasury note is 5% and the interest rate on a 5 year TIPS (inflation-indexed) is 2.5%. Using the Fisher equation, what is the average expected inflation rate over the next five years? 5. You have been given the variance of the returns on some security. You need to know the standard deviation. How can you compute it? Focus Gtv W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts