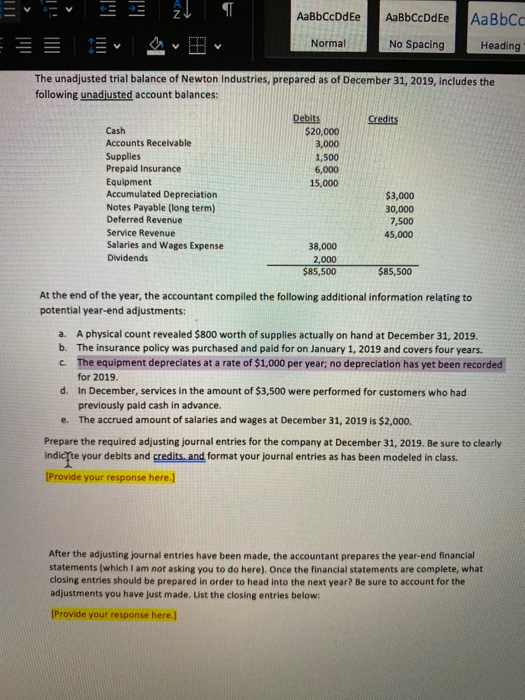

Question: AaBbCcDdEe AaBbCcDdee AaBbce Normal No Spacing Heading The unadjusted trial balance of Newton Industries, prepared as of December 31, 2019, includes the following unadjusted account

AaBbCcDdEe AaBbCcDdee AaBbce Normal No Spacing Heading The unadjusted trial balance of Newton Industries, prepared as of December 31, 2019, includes the following unadjusted account balances: Credits Debits $20,000 3,000 1,500 6,000 15,000 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Notes Payable (long term) Deferred Revenue Service Revenue Salaries and Wages Expense Dividends $3,000 30,000 7,500 45,000 38,000 2,000 $85,500 585,500 At the end of the year, the accountant compiled the following additional information relating to potential year-end adjustments: a. A physical count revealed $800 worth of supplies actually on hand at December 31, 2019. b. The insurance policy was purchased and paid for on January 1, 2019 and covers four years. c. The equipment depreciates at a rate of $1,000 per year; no depreciation has yet been recorded for 2019. d. in December, services in the amount of $3,500 were performed for customers who had previously paid cash in advance. e. The accrued amount of salaries and wages at December 31, 2019 is $2,000. Prepare the required adjusting journal entries for the company at December 31, 2019. Be sure to clearly indicate your debits and credits, and format your journal entries as has been modeled in class. (Provide your response here.] After the adjusting journal entries have been made, the accountant prepares the year-end financial statements (which I am not asking you to do here). Once the financial statements are complete, what closing entries should be prepared in order to head into the next year? Be sure to account for the adjustments you have just made. List the closing entries below: [Provide your response here.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts