Question: Aalb-Cel Aab AaBbc AaBbcc AaBb Heading enew View eferencesMailing No Aa Style 15 marks) Paragraph Soros Venture Fund has set up a portfolio that comprises

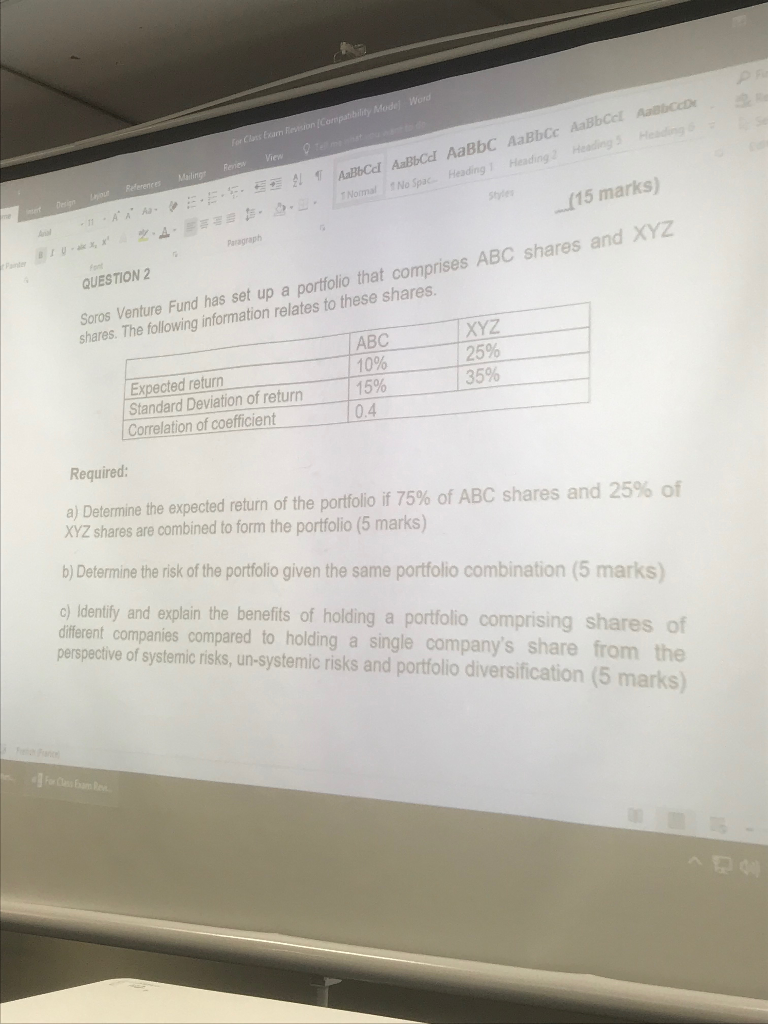

Aalb-Cel Aab AaBbc AaBbcc AaBb Heading enew View eferencesMailing No Aa Style 15 marks) Paragraph Soros Venture Fund has set up a portfolio that comprises ABC shares and XY2 shares. The following information relates to these shares. QUESTION 2 ABC 10% XYZ 25% 35% Expected return Standard Deviation of return Correlation of coefficient 15% 0.4 Required: a) Determine the expected return of the portfolio if 75% of ABC shares and 25% of XYZ shares are combined to form the portfolio (5 marks) b) Determine the risk of the portfolio given the same portfolio combination (5 marks) ) ldentily and explain the benefits of holding a portfolio comprising shares of different companies compared to holding a single company's share from the perspective of systemic risks, un-systemic risks and portfolio diversification

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts