Question: AAM3691 2021 Assignments Assignment 1 Question 1 (37 marks) Question 1.1 (12 marks) Complete the following puzzle ACROSS 4. Costs that vary in direct proportion

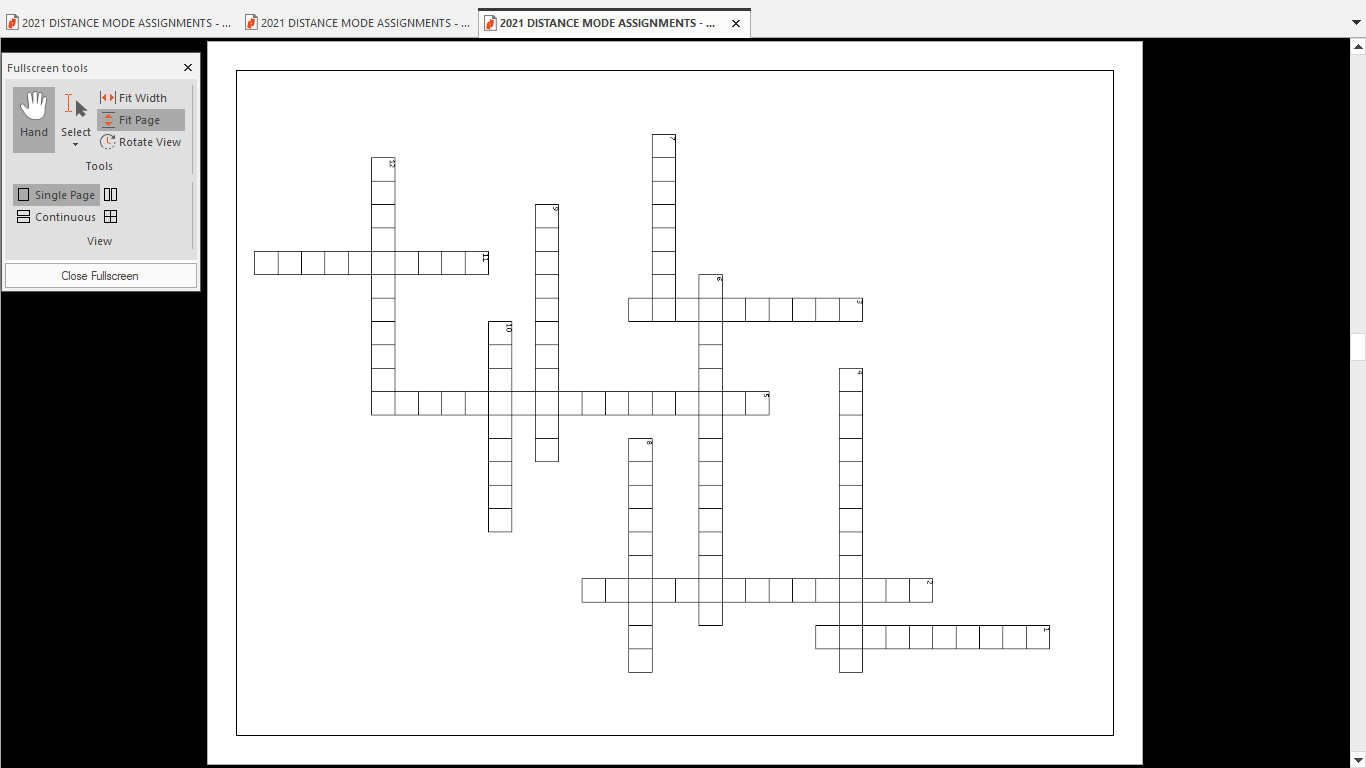

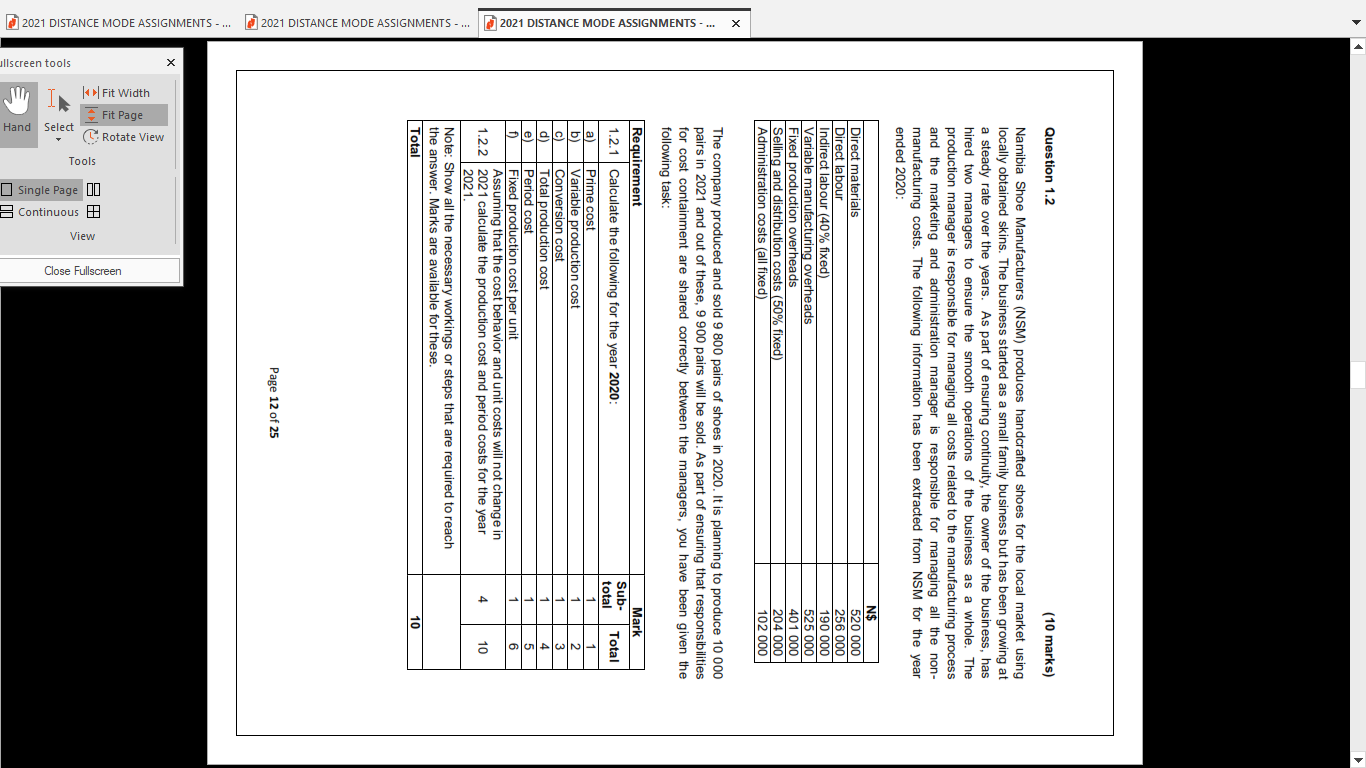

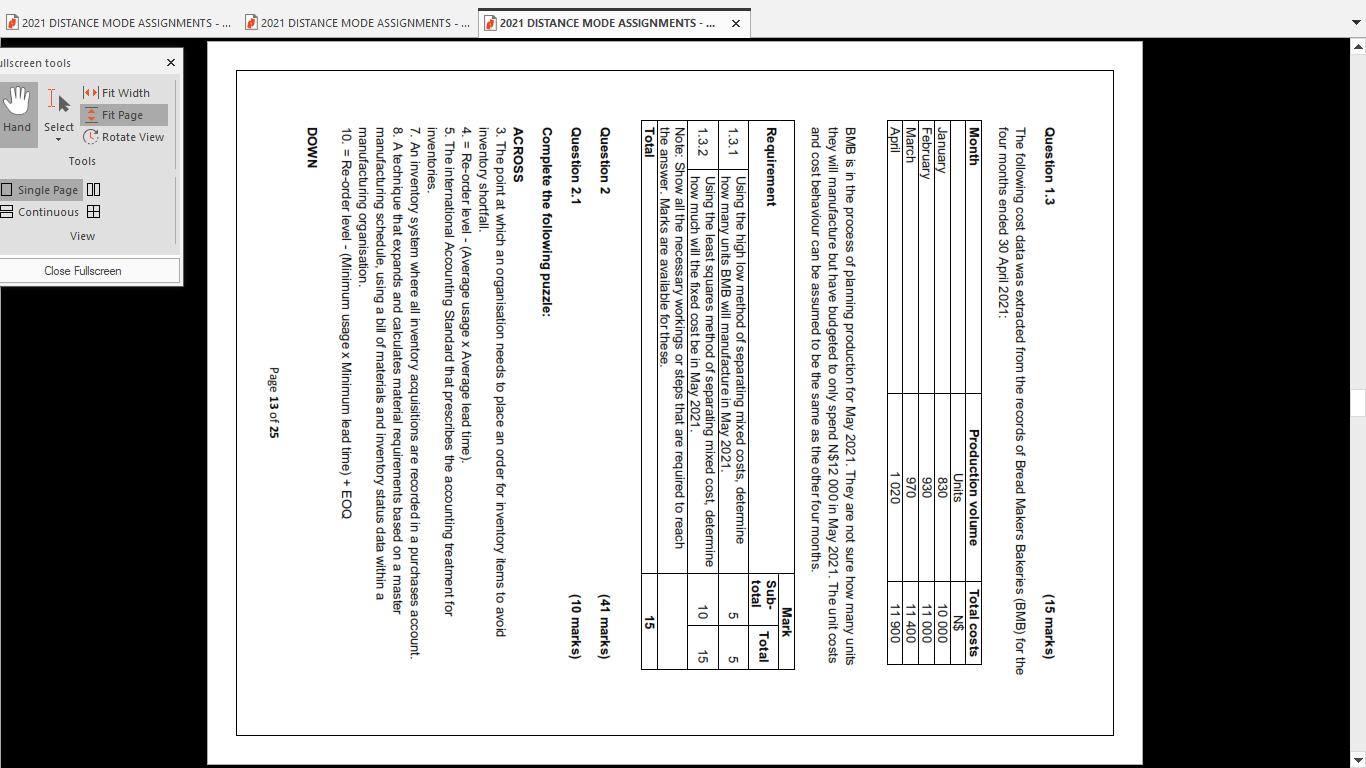

AAM3691 2021 Assignments Assignment 1 Question 1 (37 marks) Question 1.1 (12 marks) Complete the following puzzle ACROSS 4. Costs that vary in direct proportion to the volume of activity. 6. Direct labour and manufacturing overheads. 7. A cost that is irrelevant to decision making. 8. The sum of all direct manufacturing costs. 9. The sum of manufacturing costs. 10. Costs that cannot be identified specifically and exclusively with a given cost object, also known as in direct costs. 12. Expenses that are written off in the statement of profit or loss and include selling and administration costs. DOWN 1. Decreases on a a per unit basis as the number of units produced increases. 2. The benefit forgone by selecting one alternative instead of another. 3. Costs that contain both a fixed and a variable component, also known as semi-variable costs. 5. Labour costs that can be specifically and exclusively identified with a particular cost object. 11. Any activity for which a separate measurement of costs is desired. 2021 DISTANCE MODE ASSIGNMENTS Page 10 of 25 2021 DISTANCE MODE ASSIGNMENTS -... 2021 DISTANCE MODE ASSIGNMENTS - X || Fit Width Fit Page G Rotate View Tools View Single Page 10 Continuous ? Close Fullscreen Fullscreen tools 2021 DISTANCE MODE ASSIGNMENTS -... 2021 DISTANCE MODE ASSIGNMENTS -... 2021 DISTANCE MODE ASSIGNMENTS X Fullscreen tools X | Fit Width Fit Page Hand Select C.Rotate View Tools Single Page 10 3 Continuous ! View Close Fullscreen Question 1.2 (10 marks) Namibia Shoe Manufacturers (NSM) produces handcrafted shoes for the local market using locally obtained skins. The business started as a small family business but has been growing at a steady rate over the years. As part of ensuring continuity, the owner of the business, has hired two managers to ensure the smooth operations of the business as a whole. The production manager is responsible for managing all costs related to the manufacturing process and the marketing and administration manager is responsible for managing all the non- manufacturing costs. The following information has been extracted from NSM for the year ended 2020 Direct materials Direct labour Indirect labour (40% fixed) Variable manufacturing overheads Fixed production overheads Selling and distribution costs (50% fixed) Administration costs (all fixed) N$ 520 000 256 000 190 000 525 000 401 000 204 000 102 000 The company produced and sold 9 800 pairs of shoes in 2020. It is planning to produce 10 000 pairs in 2021 and out of these, 9 900 pairs will be sold. As part of ensuring that responsibilities for cost containment are shared correctly between the managers, you have been given the following task: Mark Sub- total Total 2021 DISTANCE MODE ASSIGNMENTS Requirement 1.2.1 Calculate the following for the year 2020 a) Prime cost b Variable production cost c) Conversion cost d) Total production cost e) Period cost f) Fixed production cost per unit Assuming that the cost behavior and unit costs will not change in 1.2.2 2021 calculate the production cost and period costs for the year 2021. Note: Show all the necessary workings or steps that are required to reach the answer. Marks are available for these. 1 6 4 10 Total 10 Page 12 of 25 2021 DISTANCE MODE ASSIGNMENTS -... 2021 DISTANCE MODE ASSIGNMENTS Fit Width Fit Page CRotate View ullscreen tools Single Page 10 Continuous Close Fullscreen Question 1.3 (15 marks) The following cost data was extracted from the records of Bread Makers Bakeries (BMB) for the four months ended 30 April 2021: Month January February March April Production volume Units 830 930 970 020 Total costs N$ 10 000 11 000 11 400 11 900 BMB is in the process of planning production for May 2021. They are not sure how many units they will manufacture but have budgeted to only spend N$12 000 in May 2021. The unit costs and cost behaviour can be assumed to be the same as the other four months. Requirement Mark Sub- Total total 5 5. 10 15 1.3.1 Using the high low method of separating mixed costs, determine how many units BMB will manufacture in May 2021. 1.3.2 Using the least squares method of separating mixed cost, determine how much will the fixed cost be in May 2021 Note: Show all the necessary workings or steps that are required to reach the answer. Marks are available for these. Total 15 2021 DISTANCE MODE ASSIGNMENTS Question 2 (41 marks) Question 2.1 (10 marks) Complete the following puzzle: ACROSS 3. The point at which an organisation needs to place an order for inventory items to avoid inventory shortfall. 4. = Re-order level - (Average usage x Average lead time). 5. The international Accounting Standard that prescribes the accounting treatment for inventories 7. An inventory system where all inventory acquisitions are recorded in a purchases account. 8. A technique that expands and calculates material requirements based on a master manufacturing schedule, using a bill of materials and inventory status data within a manufacturing organisation 10. = Re-order level - (Minimum usage x Minimum lead time) + EOQ DOWN Page 13 of 25 2021 DISTANCE MODE ASSIGNMENTS -... 2021 DISTANCE MODE ASSIGNMENTS Fit Width Fit Page C Rotate View B ullscreen tools Single Page 10 Continuous Close Fullscreen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts