Question: AB 491-AGRIBUSINESS MANAGEMENT CASE STUDY-CHAPTER 12; BREAKEVEN ANALYSIS Case study: Triple P Pizza Pete and Peggy Peterson are planning their retirement. They have always enjoyed

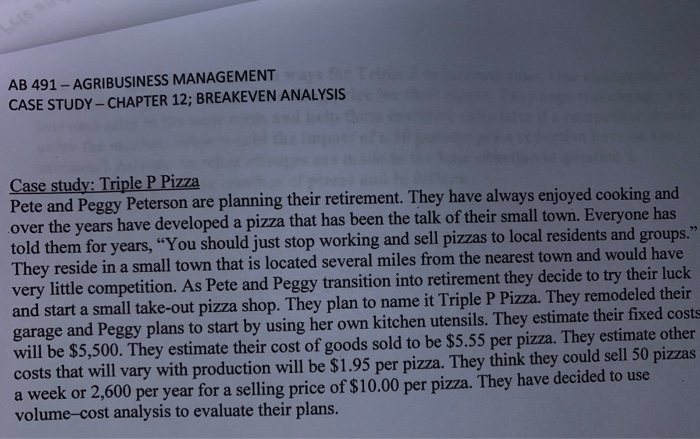

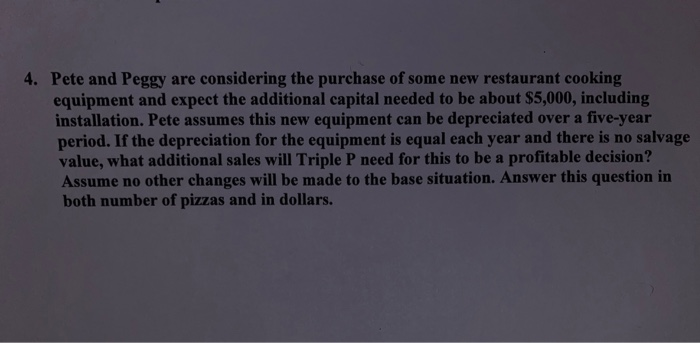

AB 491-AGRIBUSINESS MANAGEMENT CASE STUDY-CHAPTER 12; BREAKEVEN ANALYSIS Case study: Triple P Pizza Pete and Peggy Peterson are planning their retirement. They have always enjoyed cooking and over the years have developed a pizza that has been the talk of their small town. Everyone has told them for years, "You should just stop working and sell pizzas to local residents and groups." They reside ina small town that is located several miles from the nearest town and would have very little competition. As Pete and Peggy transition into retirement they decide to try their luck and start a small take-out pizza shop. They plan to name it Triple P Pizza. They remodeled the ir garage and Peggy plans to start by using her own kitchen utensils. They estimate their fixed costs will be $5,500. They estimate their cost of goods sold to be $5.55 per pizza. They estimate other costs that will vary with production will be $1.95 per pizza. They think they could sell 50 pizzas a week or 2,600 per year for a selling price of $1 0.00 per pizza. They have decided to use volume-cost analysis to evaluate their plans. 22 4. Pete and Peggy are considering the purchase of some new restaurant cooking equipment and expect the additional capital needed to be about $5,000, including installation. Pete assumes this new equipment can be depreciated over a five-year period. If the depreciation for the equipment is equal each year and there is no salvage value, what additional sales will Triple P need for this to be a profitable decision? Assume no other changes will be made to the base situation. Answer this question in both number of pizzas and in dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts