Question: A,B, and C please Here are data on three hedge funds, Each fund charges its investors an incentive fee of 20% of total returns. Suppose

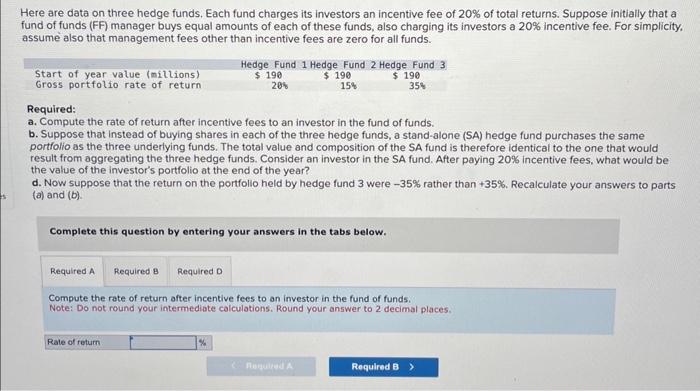

Here are data on three hedge funds, Each fund charges its investors an incentive fee of 20% of total returns. Suppose initially that a fund of funds (FF) manager buys equal amounts of each of these funds, also charging its investors a 20% incentive fee. For simplicity. assume also that management fees other than incentive fees are zero for all funds. Required: a. Compute the rate of return after incentive fees to an investor in the fund of funds. b. Suppose that instead of buying shares in each of the three hedge funds, a stand-alone (SA) hedge fund purchases the same portflilio as the three underlying funds. The total value and composition of the SA fund is therefore identical to the one that would result from aggregating the three hedge funds. Consider an investor in the SA fund. After paying 20% incentive fees, what would be the value of the investor's portfolio at the end of the year? d. Now suppose that the return on the portfolio held by hedge fund 3 were 35% rather than +35%. Recalculate your answers to parts (a) and (b). Complete this question by entering your answers in the tabs below. Compute the rate of return after incentive fees to an investor in the fund of funds. Note: Do not round your intermediate calculations. Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts