Question: ab Developing a Long-Term Financial Plan online 17-1. (Financial forecasting) Zapatera Enterprises is evaluating its financing requirements .com for the coming year. The firm has

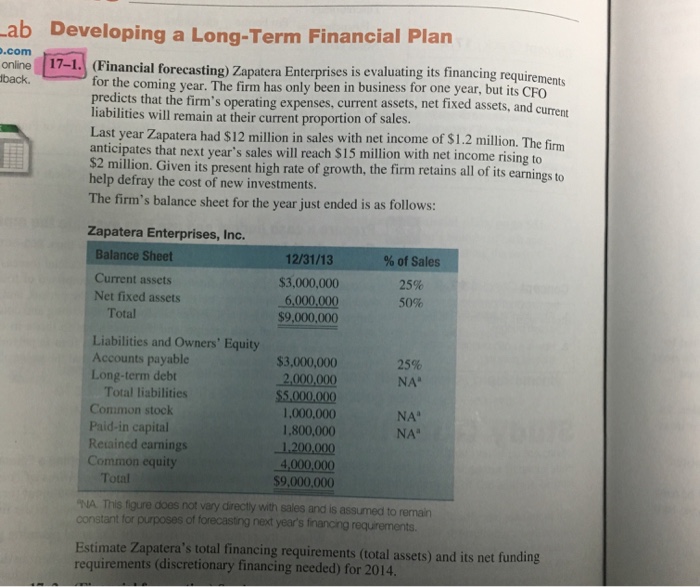

ab Developing a Long-Term Financial Plan online 17-1. (Financial forecasting) Zapatera Enterprises is evaluating its financing requirements .com for the coming year. The firm has only been in business for one year, but its CFO predicts that the firm's operating expenses, current assets, net fixed assets, and curre back. liabilities will remain at their current proportion of sales. Last year Zapatera had $12 million in sales with net income of $1.2 million. The firm anticipates that next year's sales will reach $15 million with net income rising to million. Given its present high rate of growth, the firm retains all of its earnings to help defray the cost of new investments. The firm's balance sheet for the year just ended is as follows: Zapatera Enterprises, Inc. Balance Sheet Current assets Net fixed assets 12/31/13 S3,000,000 6,000,000 $9,000,000 % of Sales 25% 50% Total Liabilities and Owners' Equity Accounts payable Long-term debt 25% NA" Total liabilities Common stock Paid-in capital Retained earnings Common equity $3,000,000 000,000 $5,000.000 1,000,000 1,800,000 1.200,000 4,000,000 $9,000,000 NA" NA" Total IA This figure does not vary directly with sales and is assumed to constant for purposes of forecasting next year's financing requirements Estimate Zapatera's total financing requirements (total assets) and its net funding requirements (discretionary financing needed) for 2014 ab Developing a Long-Term Financial Plan online 17-1. (Financial forecasting) Zapatera Enterprises is evaluating its financing requirements .com for the coming year. The firm has only been in business for one year, but its CFO predicts that the firm's operating expenses, current assets, net fixed assets, and curre back. liabilities will remain at their current proportion of sales. Last year Zapatera had $12 million in sales with net income of $1.2 million. The firm anticipates that next year's sales will reach $15 million with net income rising to million. Given its present high rate of growth, the firm retains all of its earnings to help defray the cost of new investments. The firm's balance sheet for the year just ended is as follows: Zapatera Enterprises, Inc. Balance Sheet Current assets Net fixed assets 12/31/13 S3,000,000 6,000,000 $9,000,000 % of Sales 25% 50% Total Liabilities and Owners' Equity Accounts payable Long-term debt 25% NA" Total liabilities Common stock Paid-in capital Retained earnings Common equity $3,000,000 000,000 $5,000.000 1,000,000 1,800,000 1.200,000 4,000,000 $9,000,000 NA" NA" Total IA This figure does not vary directly with sales and is assumed to constant for purposes of forecasting next year's financing requirements Estimate Zapatera's total financing requirements (total assets) and its net funding requirements (discretionary financing needed) for 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts