Question: a,b Exercise 5-11B Allocating facility level costs and a product elimination decision York Corporation produces two types of juice that it packages in cases of

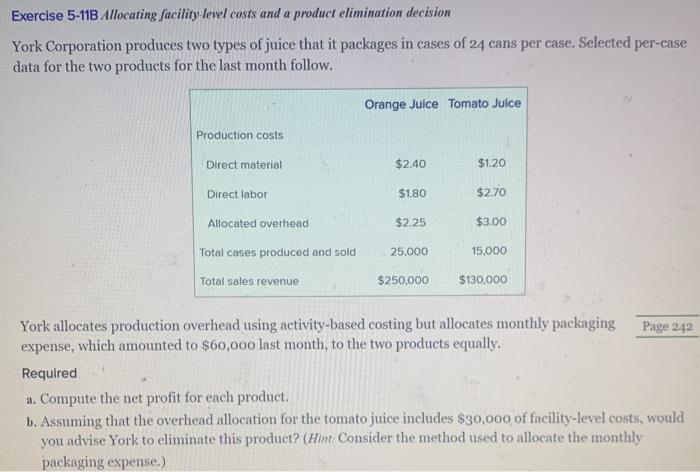

Exercise 5-11B Allocating facility level costs and a product elimination decision York Corporation produces two types of juice that it packages in cases of 24 cans per case. Selected per-case data for the two products for the last month follow. Orange Juice Tomato Juice Production costs Direct material $2.40 $1.20 Direct labor $1.80 $2.70 $2.25 $3.00 Allocated overhead Total cases produced and sold 25,000 15.000 Total sales revenue $250,000 $130,000 York allocates production overhead using activity-based costing but allocates monthly packaging Page 242 expense, which amounted to $60,000 last month, to the two products equally. Required a. Compute the net profit for each product. b. Assuming that the overhead allocation for the tomato juice includes $30,000 of facility-level costs, would you advise York to eliminate this product? (Hint: Consider the method used to allocate the monthly packaging expense.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts