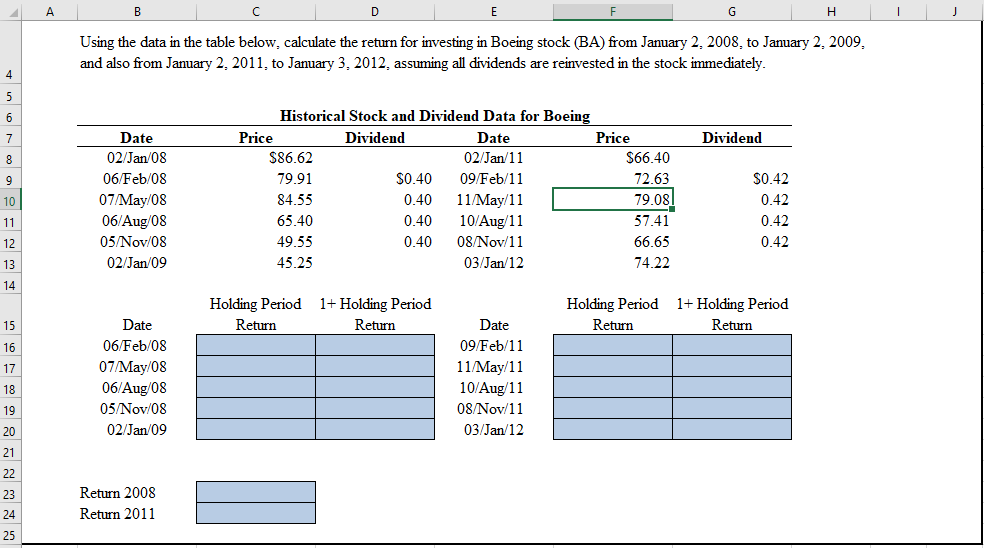

Question: AB F Using the data in the table below, calculate the return for investing in Boeing stock (BA) from January 2, 2008. to January 2,

AB F Using the data in the table below, calculate the return for investing in Boeing stock (BA) from January 2, 2008. to January 2, 2009, and also from January 2, 2011, to January 3, 2012, assuming all dividends are reinvested in the stock immediately. Dividend Date 02/Jan/08 06/Feb/08 07/May/08 06/Aug/08 05/Nov/08 02/Jan/09 Historical Stock and Dividend Data for Boeing Price Dividend Date Price $86.62 02/Jan/11 $66.40 79.91 $0.40 09/Feb/11 72.63 84.55 0.40 11/May/11 79.08! 65.40 0.40 10/Aug/11 57.41 49.55 0.40 08/Nov/11 66.65 45.25 03/Jan/12 74.22 $0.42 0.42 0.42 0.42 Holding Period Return 1+ Holding Period Return Holding Period Return 1+ Holding Period Return Date 06/Feb/08 07/May/08 06/Aug/08 05/Nov/08 02/Jan/09 Date 09/Feb/11 11/May/11 10/Aug/11 08/Nov/11 03/Jan/12 Return 2008 Return 2011 In cell C16, by using cell references, calculate the holding period return for 06-Feb-08 (1 pt.). To calculate the holding period return for 07-May-08, 06-Aug-08, etc., copy cell C16 and paste it onto cells C17:C20 (1 pt.) and cells F16:F20 (1 pt.). In cell D16, add 1 to the holding period return for 06-Feb-08 (1 pt.). Copy cell D16 and paste it onto cells D17:D20 (1 pt.) and cells G16:G20 (1 pt.). Calculate the return for investing in the stock from January 2, 2008, to January 2, 2009 by using the function PRODUCT. In cell C23, by using the function PRODUCT and cell references, calculate the return for investing in the stock from January 2, 2008, to January 2, 2009 (1 pt.). Hint: Remember to subtract 1 from the product to find the holding period return. Calculate the return for investing in the stock from January 2, 2011, to January 3, 2012. In cell C24, by using the function PRODUCT and cell references, calculate the return for investing in the stock from January 2, 2011, to January 3, 2012 (1 pt.). Hint: Remember to subtract 1 from the product to find the holding period return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts