Question: a&b please!! B Strip Mining Inc. can develop a new mine at an Initial cost of $13 million. The mine will provide a cash flow

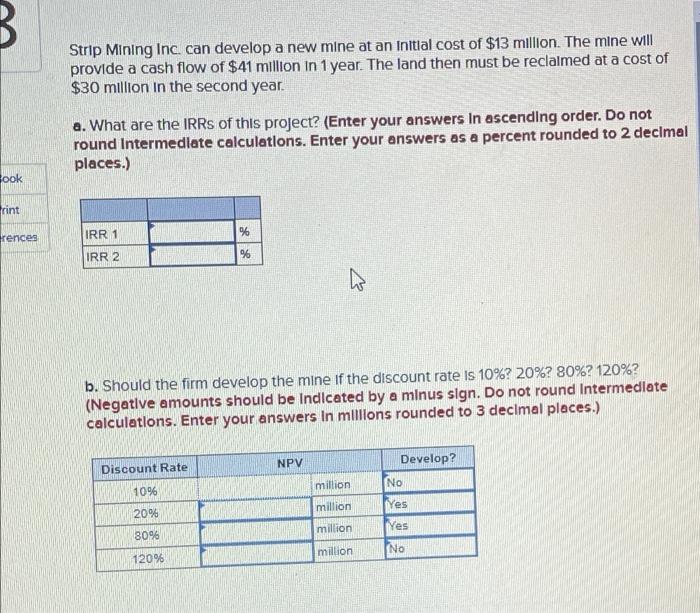

B Strip Mining Inc. can develop a new mine at an Initial cost of $13 million. The mine will provide a cash flow of $41 million in 1 year. The land then must be reclaimed at a cost of $30 million in the second year. a. What are the IRRs of this project? (Enter your answers in ascending order. Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) ook Print rences % IRR 1 IRR 2 % b. Should the firm develop the mine if the discount rate is 10% 20%? 80%? 120%? (Negative amounts should be Indicated by a minus sign. Do not round Intermediate calculations. Enter your answers in millions rounded to 3 decimal places.) NPV Develop? Discount Rate million No 10% million Ves 20% million 'Yes 8096 million No 120%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts