Question: Abacus and Barnacle are identical in all respects except for capital structure. Abacus has an all equity capital structure, while Barnacle has a mixed

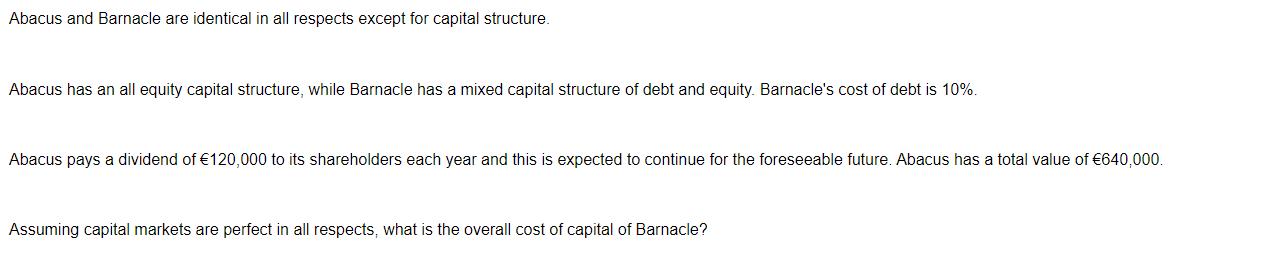

Abacus and Barnacle are identical in all respects except for capital structure. Abacus has an all equity capital structure, while Barnacle has a mixed capital structure of debt and equity. Barnacle's cost of debt is 10%. Abacus pays a dividend of 120,000 to its shareholders each year and this is expected to continue for the foreseeable future. Abacus has a total value of 640,000. Assuming capital markets are perfect in all respects, what is the overall cost of capital of Barnacle?

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Since Abacus and Barnacle are identical in all respects except for capital structure we can use the ... View full answer

Get step-by-step solutions from verified subject matter experts