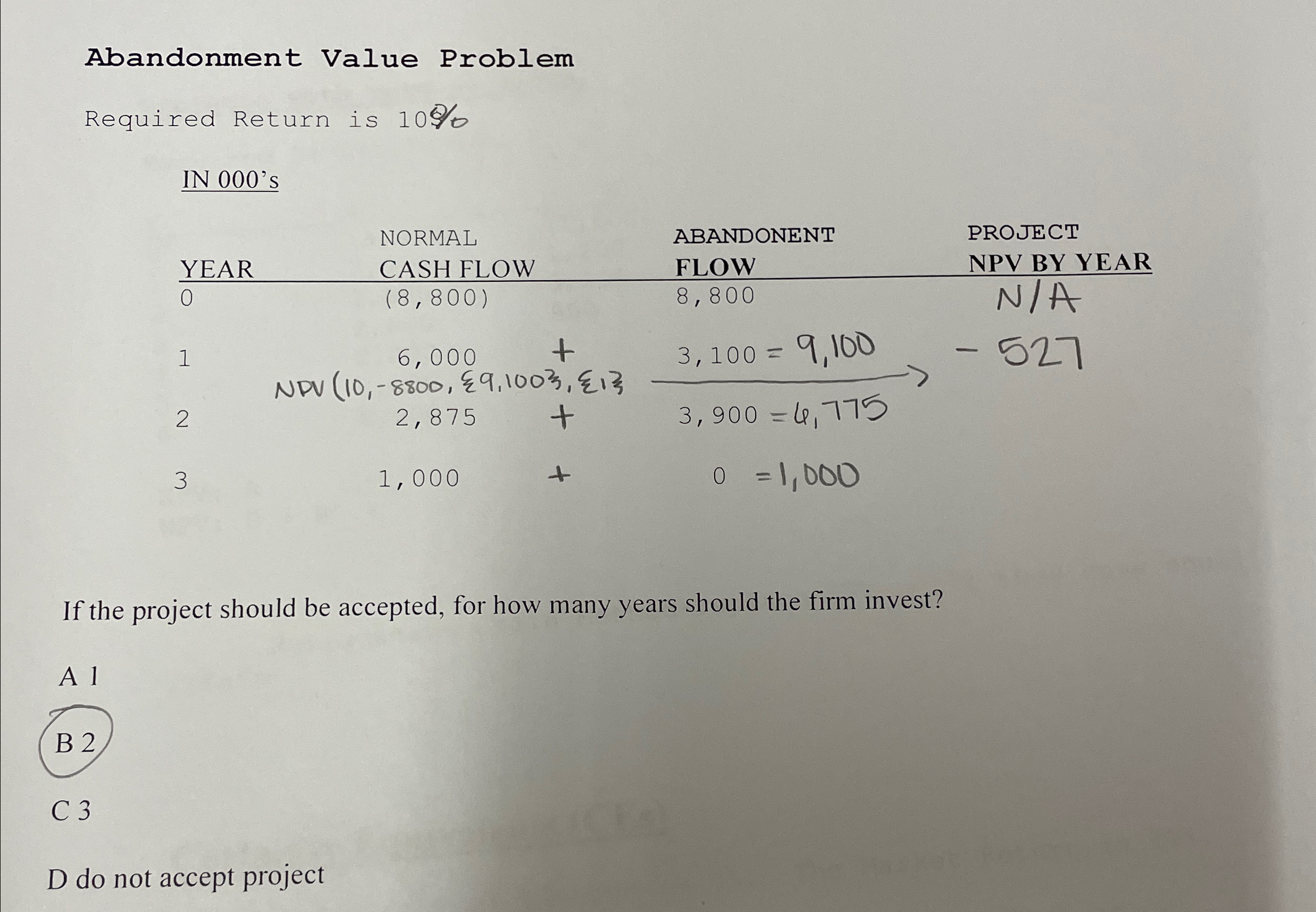

Question: Abandonment Value Problem Required Return is 10% IN 000's NORMAL YEAR 0 CASH FLOW (8,800) 1 ABANDONENT FLOW 8,800 PROJECT NPV BY YEAR 2

Abandonment Value Problem Required Return is 10% IN 000's NORMAL YEAR 0 CASH FLOW (8,800) 1 ABANDONENT FLOW 8,800 PROJECT NPV BY YEAR 2 3 6,000 NPV (10, -8800, 9,100}, {{1}} 2,875 + 3,100 = 9,100 N/A -527 + 3,900 = 4,775 1,000 + 0 = 1,000 If the project should be accepted, for how many years should the firm invest? Al B2 C 3 D do not accept project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts