Question: Abbas Ltd. Basic Bookkeeping Abbas has decided to set up in business selling football shirts in the market place. Following transactions took place fien k

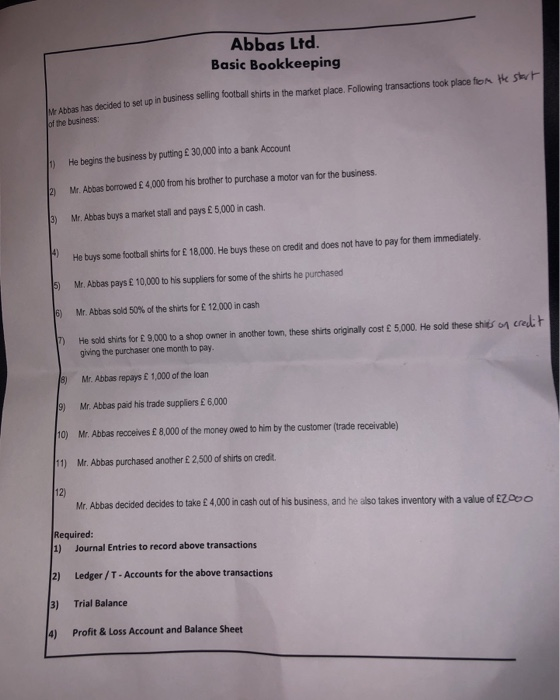

Abbas Ltd. Basic Bookkeeping Abbas has decided to set up in business selling football shirts in the market place. Following transactions took place fien k St of the business He begins the business by putting E 30,000 into a bank Account 1) Mr. Abbas borrowed 4,000 from his brother to purchase a motor van for the business. 2) Mr. Abbas buys a market stall and pays 5,000 in cash. 3) 4) He buys some football shirts for 18,000. He buys these on credit and does not have to pay for them immediately. Mr. Abbas pays 10,000 to his suppliers for some of the shirts he purchased 5) Mr. Abbas sold 50% of the shirts for 12.000 in cash 6) credit He sold shirts for 9,000 to a shop owner in another town, these shirts originally cost 5,000. He sold these shits on 7) giving the purchaser one month to pay. 8) Mr. Abbas repays 1,000 of the loan 9) Mr. Abbas paid his trade suppliers 6,000 Mr. Abbas recceives 8,000 of the money owed to him by the customer (trade receivable) 10) Mr. Abbas purchased another 2,500 of shirts on credit. 11) 12) Mr. Abbas decided decides to take 4,000 in cash out of his business, and he also takes inventory with a value of 2000 Required: 1) Journal Entries to record above transactions 2) Ledger /T-Accounts for the above transactions 3) Trial Balance Profit & Loss Account and Balance Sheet 4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts