Question: Abbey would like to purchase a nice dining room table and so is saving up for it. The table costs $10,000. She plans to make

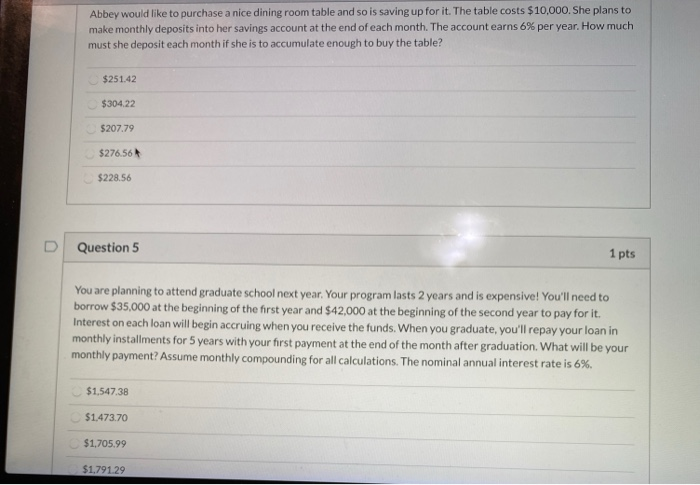

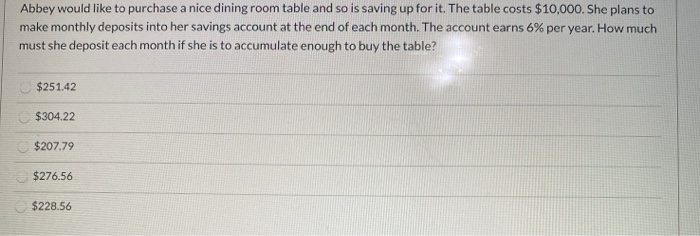

Abbey would like to purchase a nice dining room table and so is saving up for it. The table costs $10,000. She plans to make monthly deposits into her savings account at the end of each month. The account earns 6% per year. How much must she deposit each month if she is to accumulate enough to buy the table? $251.42 $304.22 5207.79 $276,56 $228.56 D Question 5 1 pts You are planning to attend graduate school next year. Your program lasts 2 years and is expensive! You'll need to borrow $35,000 at the beginning of the first year and $42,000 at the beginning of the second year to pay for it. Interest on each loan will begin accruing when you receive the funds. When you graduate, you'll repay your loan in monthly installments for 5 years with your first payment at the end of the month after graduation. What will be your monthly payment? Assume monthly compounding for all calculations. The nominal annual interest rate is 6%. $1.547.38 $1.473.70 $1.705.99 $1.791.29 Abbey would like to purchase a nice dining room table and so is saving up for it. The table costs $10,000. She plans to make monthly deposits into her savings account at the end of each month. The account earns 6% per year. How much must she deposit each month if she is to accumulate enough to buy the table? $251.42 $304.22 $207.79 $276.56 $228.56 Abbey would like to purchase a nice dining room table and so is saving up for it. The table costs $10,000. She plans to make monthly deposits into her savings account at the end of each month. The account earns 6% per year. How much must she deposit each month if she is to accumulate enough to buy the table? $251.42 $304.22 5207.79 $276,56 $228.56 D Question 5 1 pts You are planning to attend graduate school next year. Your program lasts 2 years and is expensive! You'll need to borrow $35,000 at the beginning of the first year and $42,000 at the beginning of the second year to pay for it. Interest on each loan will begin accruing when you receive the funds. When you graduate, you'll repay your loan in monthly installments for 5 years with your first payment at the end of the month after graduation. What will be your monthly payment? Assume monthly compounding for all calculations. The nominal annual interest rate is 6%. $1.547.38 $1.473.70 $1.705.99 $1.791.29 Abbey would like to purchase a nice dining room table and so is saving up for it. The table costs $10,000. She plans to make monthly deposits into her savings account at the end of each month. The account earns 6% per year. How much must she deposit each month if she is to accumulate enough to buy the table? $251.42 $304.22 $207.79 $276.56 $228.56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts