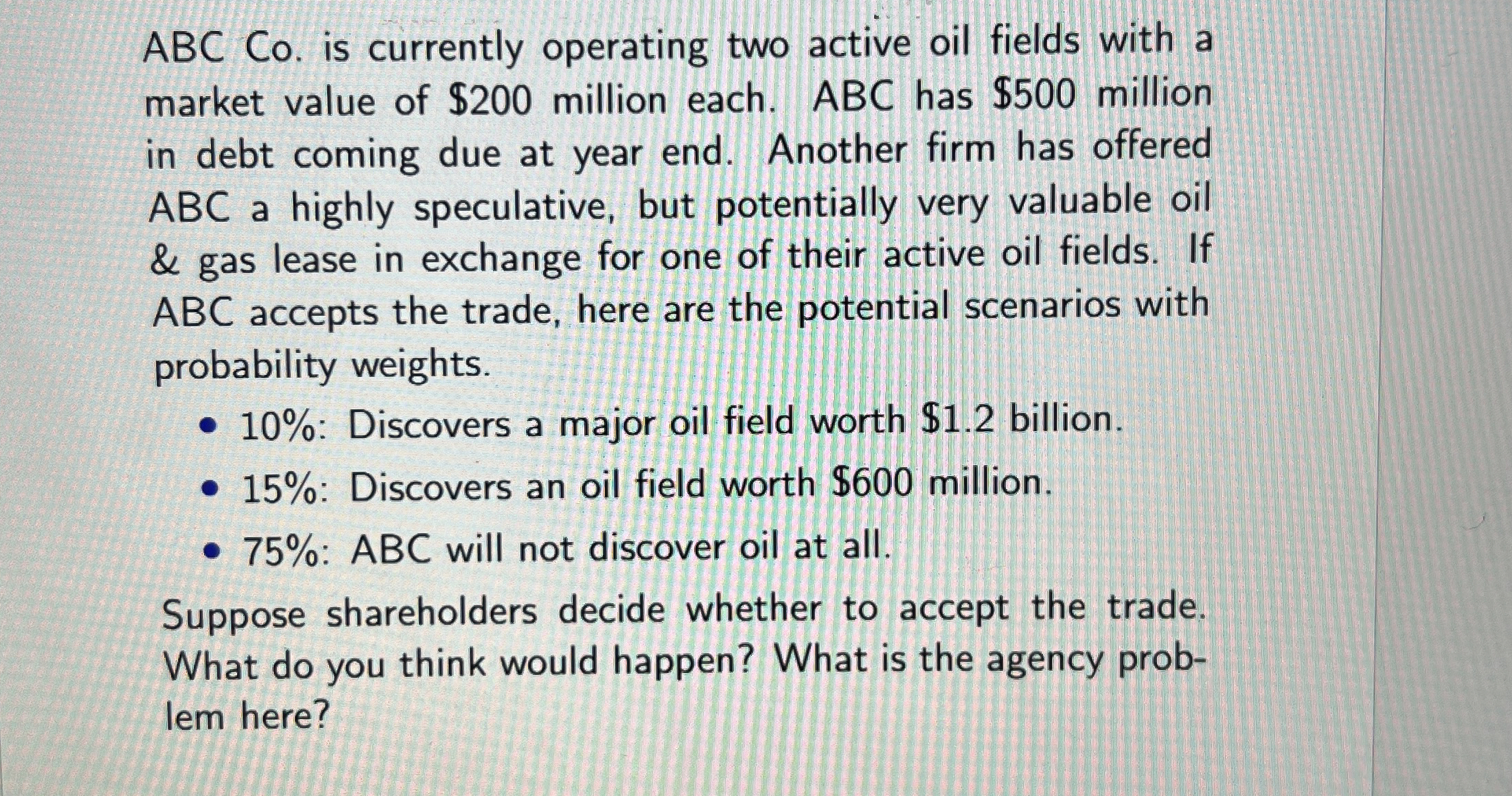

Question: ABC Co . is currently operating two active oil fields with a market value of $ 2 0 0 million each. ABC has $ 5

ABC Co is currently operating two active oil fields with a

market value of $ million each. ABC has $ million

in debt coming due at year end. Another firm has offered

ABC a highly speculative, but potentially very valuable oil

& gas lease in exchange for one of their active oil fields. If

ABC accepts the trade, here are the potential scenarios with

probability weights.

: Discovers a major oil field worth $ billion.

: Discovers an oil field worth $ million.

: ABC will not discover oil at all.

Suppose shareholders decide whether to accept the trade.

What do you think would happen? What is the agency prob

lem here?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock