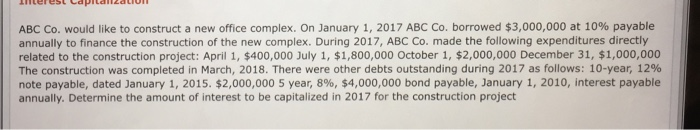

Question: ABC Co. would like to construct a new office complex. On January 1, 2017 ABC Co. borrowed $3,000,000 at 10% payable annually to finance the

ABC Co. would like to construct a new office complex. On January 1, 2017 ABC Co. borrowed $3,000,000 at 10% payable annually to finance the construction of the new complex. During 2017, ABC Co. made the following expenditures directly related to the construction project: April 1, $400,000 July 1, $1,800,000 October 1, $2,000,000 December 31, $1,000,000 The construction was completed in March, 2018. There were other debts outstanding during 2017 as follows: 10-year, 12% note payable, dated January 1, 2015, $2,000,000 5 year, 8%, $4,000,000 bond payable, January 1, 2010, interest payable annually. Determine the amount of interest to be capitalized in 2017 for the construction project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts