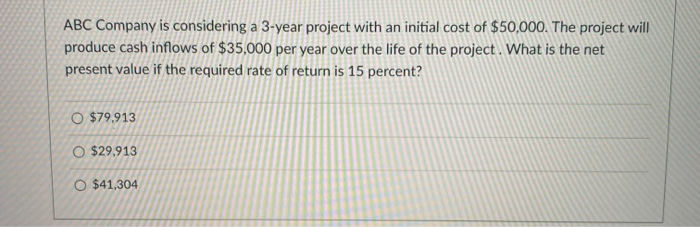

Question: ABC Company is considering a 3-year project with an initial cost of $50,000. The project will produce cash inflows of $35,000 per year over the

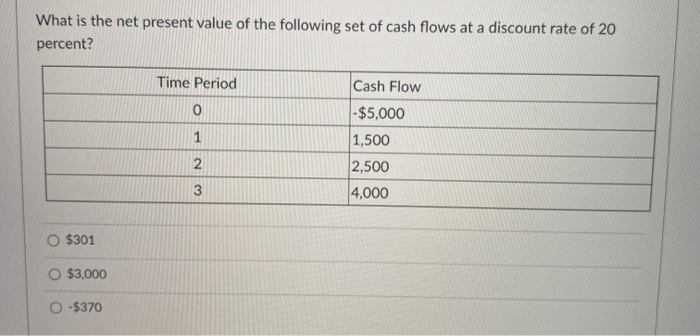

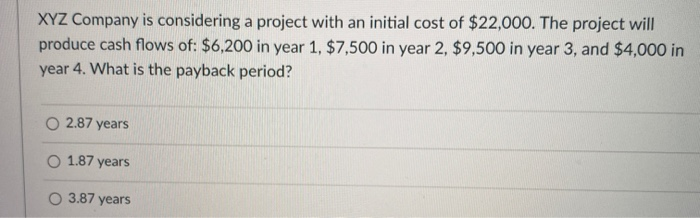

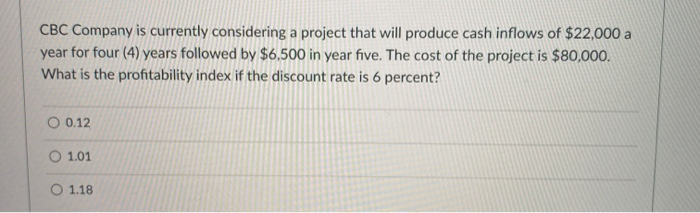

ABC Company is considering a 3-year project with an initial cost of $50,000. The project will produce cash inflows of $35,000 per year over the life of the project. What is the net present value if the required rate of return is 15 percent? O $79.913 O $29.913 O $41,304 What is the net present value of the following set of cash flows at a discount rate of 20 percent? Time Period Cash Flow 0 1 - $5,000 1,500 2,500 2 3 4,000 O $301 O $3,000 O -$370 XYZ Company is considering a project with an initial cost of $22,000. The project will produce cash flows of: $6,200 in year 1, $7,500 in year 2, $9,500 in year 3, and $4,000 in year 4. What is the payback period? 2.87 years 1.87 years 3.87 years CBC Company is currently considering a project that will produce cash inflows of $22,000 a year for four (4) years followed by $6,500 in year five. The cost of the project is $80,000. What is the profitability index if the discount rate is 6 percent? O 0.12 O 1.01 O 1.18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts