Question: ABC Company is considering two mutually exclusive, equally risky projects, S and L with the following cash flows. The cost of capital for both projects

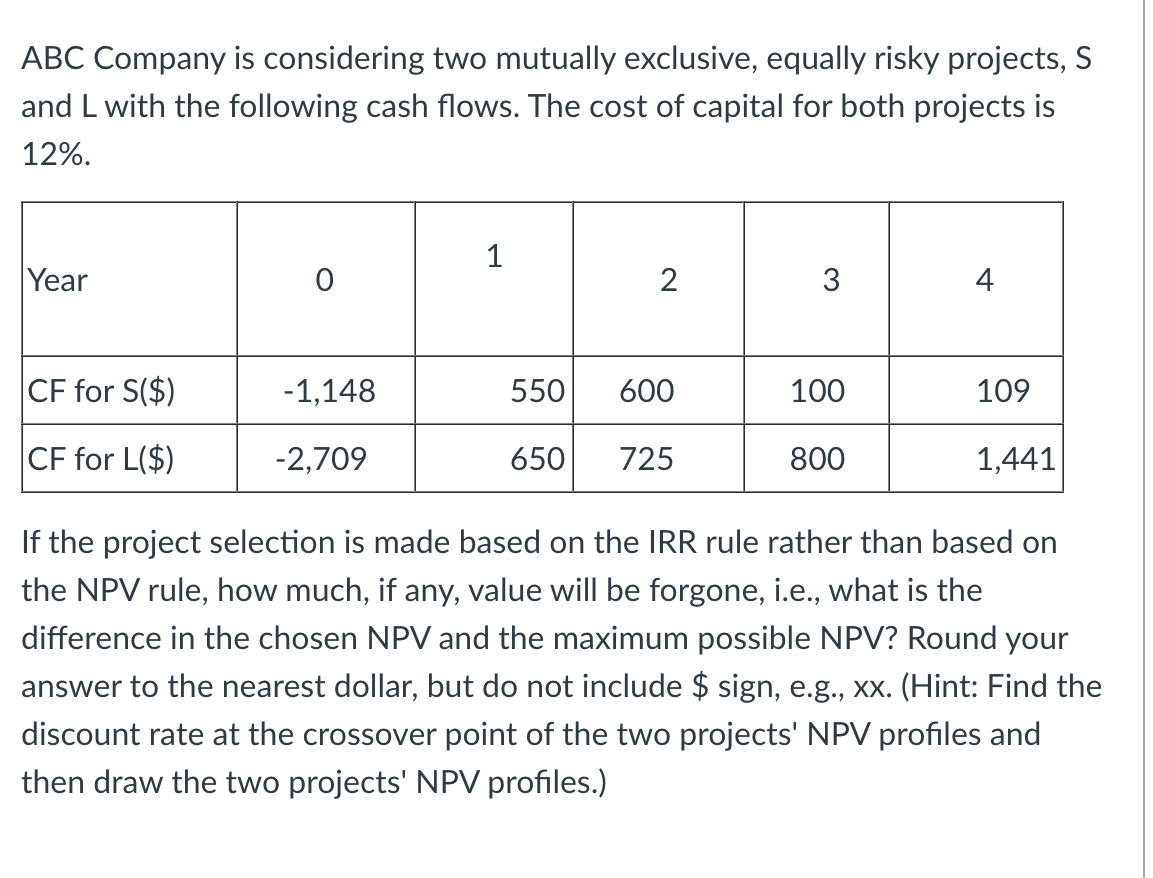

ABC Company is considering two mutually exclusive, equally risky projects, S and L with the following cash flows. The cost of capital for both projects is 12%. 1 Year O 2 3 4. CF for S($) -1,148 550 600 100 109 CF for L($) -2,709 650 725 800 1,441 If the project selection is made based on the IRR rule rather than based on the NPV rule, how much, if any, value will be forgone, i.e., what is the difference in the chosen NPV and the maximum possible NPV? Round your answer to the nearest dollar, but do not include $ sign, e.g., xx. (Hint: Find the discount rate at the crossover point of the two projects' NPV profiles and then draw the two projects' NPV profiles.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts