Question: ABC Company uses a standard cost system. The month's data regarding its product in actual and standard as follow: Actual Direct material cost per pound

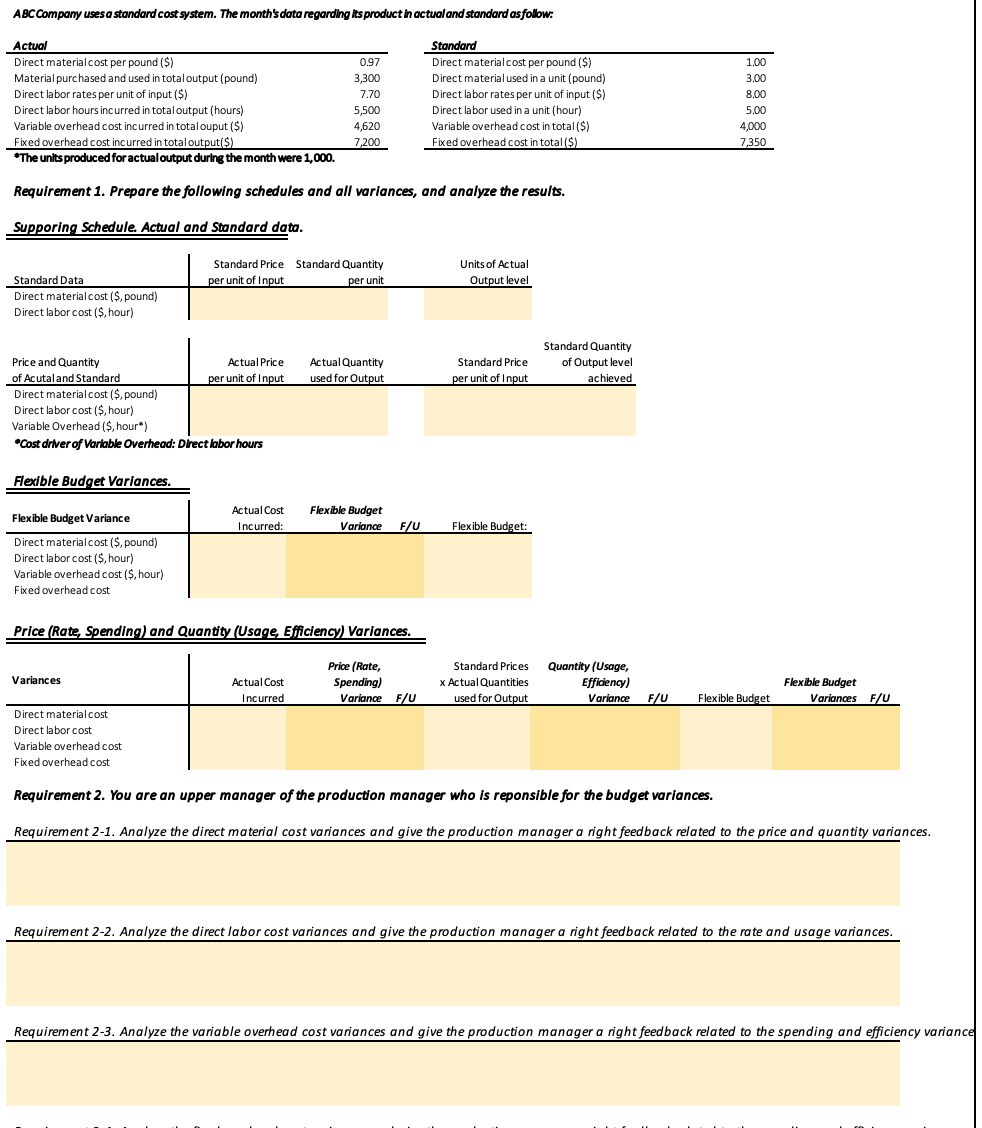

ABC Company uses a standard cost system. The month's data regarding its product in actual and standard as follow: Actual Direct material cost per pound ($) Material purchased and used in total output (pound) Direct labor rates per unit of input ($) Direct labor hours incurred in total output (hours) Variable overhead cost incurred in totalouput ($) Fixed overhead cost incurred in total output($) *The units produced for actual output during the month were 1,000. 0.97 3,300 7.70 5,500 4,620 7,200 Standard Direct material cost per pound ($) Direct material used in a unit (pound) Direct labor rates per unit of input($) Direct labor used in a unit (hour) Variable overhead cost in total ($) Fixed overhead cost in total($) 1.00 3.00 8.00 5.00 4,000 7,350 Requirement 1. Prepare the following schedules and all variances, and analyze the results. Supporing Schedule. Actual and Standard data. Standard Price Standard Quantity per unit of Input per unit Units of Actual Output level Standard Data Direct material cost ($. pound) Direct labor cost ($ hour) Actual Quantity used for Output Standard Price per unit of Input Standard Quantity of Output level achieved Price and Quantity Actual Price of Acutaland Standard per unit of Input Direct material cost ($. pound) Direct labor cost ($ hour) Variable Overhead ($ hour") Cost driver of Variable Overhead: Direct labor hours Flexible Budget Variances. Flexible Budget Variance Actual Cost Incurred: Flexible Budget Variance F/U Flexible Budget: Direct material cost ($ pound) Direct labor cost ($, hour) Variable overhead cost ($, hour) Fixed overhead cost Price (Rate, Spending) and Quantity (Usage Efficiency) Variances. Variances Actual Cost Incurred Price (Rate, Spending) Variance F/U Standard Prices Quantity (Usage, x Actual Quantities Efficiency) used for Output Variance F/U Flexible Budget Variances F/U Flexible Budget Direct material cost Direct labor cost Variable overhead cost Fixed overhead cost Requirement 2. You are an upper manager of the production manager who is reponsible for the budget variances. Requirement 2-1. Analyze the direct material cost variances and give the production manager a right feedback related to the price and quantity variances. Requirement 2-2. Analyze the direct labor cost variances and give the production manager a right feedback related to the rate and usage variances. Requirement 2-3. Analyze the variable overhead cost variances and give the production manager a right feedback related to the spending and efficiency variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts